My question is around pty Ltd taxation. Small businesses pay tax at 25 percent or so right.

So is this tax paid on the gross income or am I correct in assuming is paid on the gross profit?

Example

Company bills labour out at 100 an hour for 40 hours

This equates to 4000 dollars gross profit.

Is tax paid at this point paying 1000 dollars in tax.

Or do you then subtract say 50 dollars an hour of wages for 40 hours resulting I’m a net profit of 2000 then pay tax on 2000 dollars left in the companies account of 500 dollars tax?

Then the employee pays their share of tax on the 2000 dollars the company paid to them?

Secondly, if the company pays super on the hours worked, do they pay tax after super is deducted or before super is deducted from profits?

Sorry if this is confusing I’m very confused to begin with.

I Want to talk to an accountant but this time of year isn’t the best for that, so I’m just trying to get some understanding before I go in and talk to one in the new year.

Tax rate is 30% or 25% if you qualify

https://www.ato.gov.au/tax-rates-and-codes/company-tax-rate-changes#ato-Companytaxrates

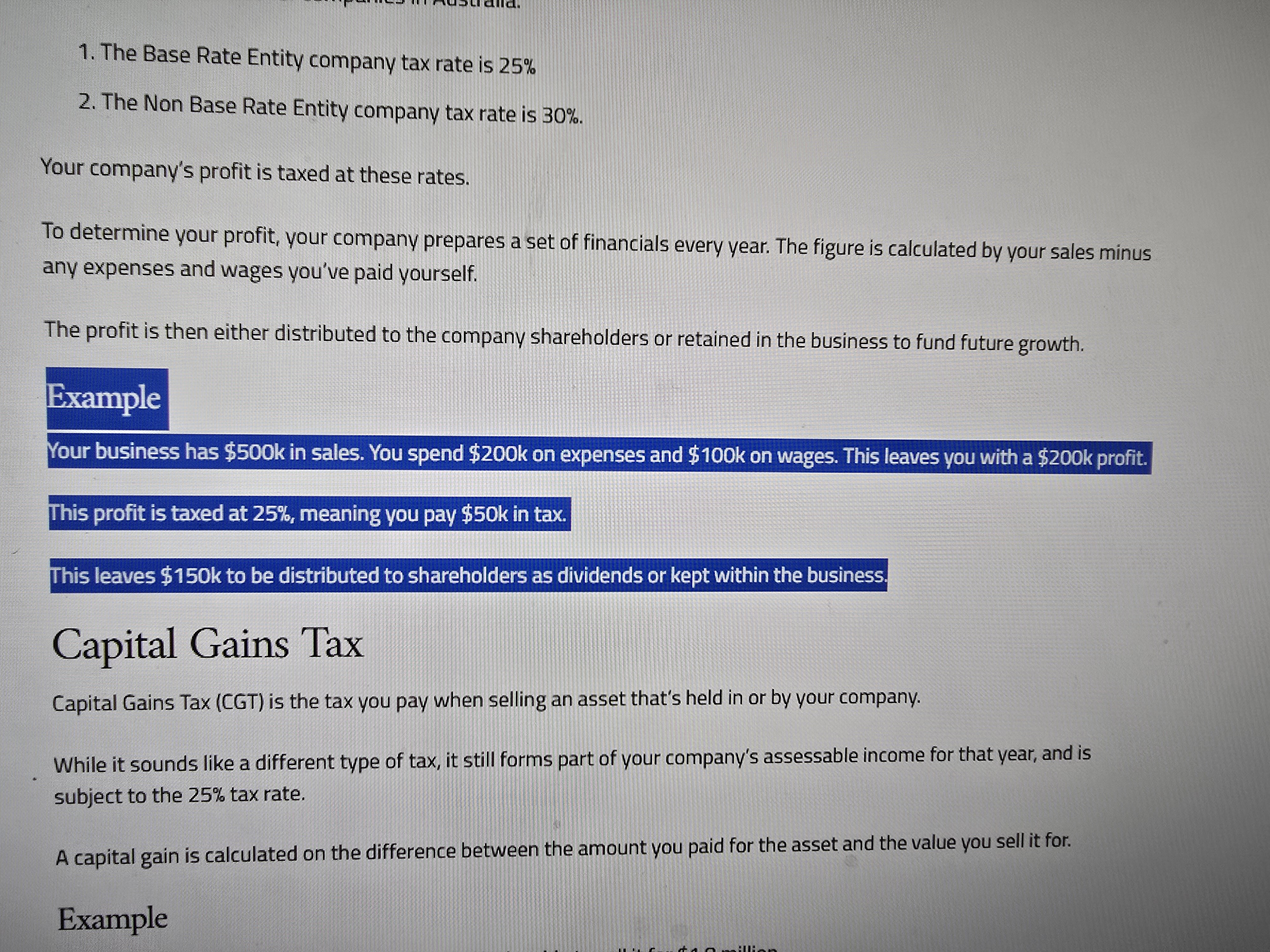

Income Tax is paid on your NET profit. So in your example you expense accoutant fees, office supploes, electricity, insurance, lease payments, interet on loan payments etc etc and then whatever is left is your net profit and that’s taxed.

Employees have income tax you collect and remit on their behalf ASSUMING they are employees and not contractors. Your other liabites are super, collected and remitted by you, and state based workers insutance. Do not forget there’s also employee liabities like amortised long service leave that’s not expensed on your P&L but shows up on your Balance Sheet and expensed when paid.

Remember you will also have GST to contend with, thats either paid for (or refunded) by submitting a BAS periodically.

There are other esoteric taxes as well you might have to contend with depending in what you are doing. FBT etc

Asking these questions is a red flag if you’re starting a business, do a TAFE intro to business course or something similar. Learning the hard way is not recommend when you are dealing with the ATO.

I see you found part of your answer.

Re super, it is basically paid pre tax. But it still counts as an expense for the company. It doesn’t count as part of the employee’s salary.

Also, note that you may need to withhold part of the employees salary as PAYG tax, and send that to the ATO. This is not company tax; it’s tax from the employees that companies collect for the government.

Highly recommend you get yourself an accountant or bookkeeper to help with this.

Cheers i appreciate it.

I am going to see an accountant next year to get all around it.

The PTY LTD pays the company tax rate at the end of the financial year on the net profit (income minus expenses including wages and any business operations expenses). Usually you will account for all this in your bookkeeping system and the tax agent will do a tax return for the business, which is very similar to a personal tax return.

In addition, any business may need to collect and then pay

- superannuation (11.5% of wages)

- PAYG component of each employees wage

- GST if registered (10% of everything the biz sells - 10% of everything the biz buys, noting somethings are GST free)

Thanks mate, I appreciate it.

Ok so after several hours of looking on line I found what i believe is the answer.