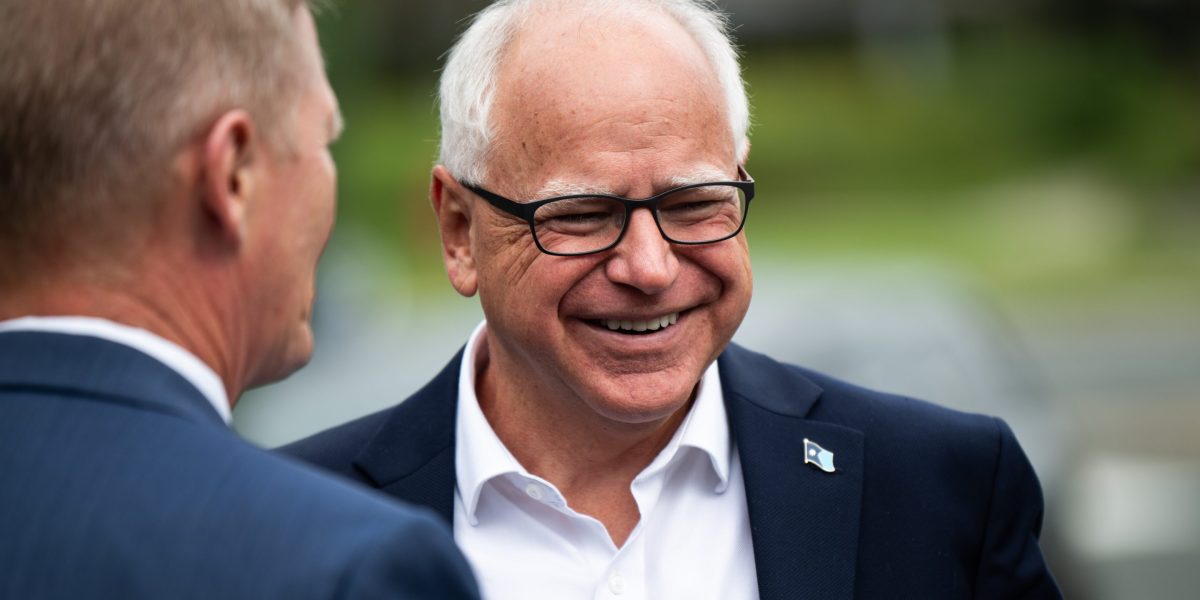

The all-American working man demeanor of Tim Walz—Kamala Harris’s new running mate—looks like it’s not just an act.

Financial disclosures show Tim Walz barely has any assets to his name. No stocks, bonds, or even property to call his own. Together with his wife, Gwen, his net worth is $330,000, according to a report by the Wall Street Journal citing financial disclosures from 2019, the year after he became Minnesota governor.

With that kind of meager nest egg, he would be more or less in line with the median figure for Americans his age (he’s 60), and even poorer than the average. One in 15 Americans is a millionaire, a recent UBS wealth report discovered.

Meanwhile, the gross annual income of Walz and his wife, Gwen, amounted to $166,719 before tax in 2022, according to their joint return filed that same year. Walz is even entitled to earn more than the $127,629 salary he receives as state governor, but he has elected not to receive the roughly $22,000 difference.

“Walz represents the stable middle class,” tax lawyer Megan Gorman, who authored a book on the personal finances of U.S. presidents, told the paper.

This does gloss over the multiple pensions, doesn’t it?

deleted by creator

That isn’t what the parent comment stated. If I had a pension I’d include it in my net worth. It should be included if it wasn’t. Missing something like a retirement account or pension (most people’s highest value asset) will just allow people to dismiss these figures (regardless of how little the impact would be).

Edit: based upon replies it looks like I wasn’t clear in my comment. I’m not saying that including the pension changes the point of the article. But by leaving information out it might give some people an excuse to dismiss the whole thing.

deleted by creator

Can you explain?

I realize the point of the article is that he isn’t some wealthy elite like the vast majoring of politicians. I think if one wishes to drive this point to everyone, one should not leave out details that would allow someone to dismiss it entirely no matter how wrong they would be for dismissing it.

I’m not saying it should be dismissed. Perhaps I wasn’t clear about that. I’m looking at it from the perspective of trying to change or win minds. And I think it’s best to include a more complete picture even if the additional details do not change the picture much if at all.

deleted by creator

I’m not upset. The other commentor might be. But I’m not.

I guess I always thought you included retirement accounts in net worth because they carry a cash value even if it hasn’t been cashed out yet. Just like you would include shares in a company in someone’s net worth even if they hadn’t sold the shares.

Perhaps pensions are slightly different. Everyone I work with who opted for the pension over a 401k includes their pension in their net worth and, to my understanding, so do the financial planners that work with the Union.

deleted by creator

The significance is that he doesn’t control how his pension is funded. It’s not like he has a vested interest in one company succeeding by having a bunch of stock there, and he’s been in politics since the aughts. It’s refreshing when compared to other congressmen

Oh I agree completely. The problem is that when talking about this stuff in the scope of changing minds, if you neglect information people too easily dismiss it.

deleted by creator

I agree to your last comment about it being refreshing that he’s not some elite like so many others. Sorry that wasn’t clear.

But pension typically isn’t included in net worth unless it’s unspent money, and given how small the average public school teacher’s pension is in comparison to their expenses, wouldn’t you agree it makes little sense to say his pension automatically should be added to his net worth?

A couple grand a month is what I expect a retired teacher to get for their pension. And a couple grand a month is what I expect a retired teacher to spend on rent/mortgage + food + other expenses.

My point wasn’t that it makes a big difference (I actually acknowledged that in my comment).

But what was your point, if spent pension money isn’t considered a part of net income? If you’re a retired private sector CEO, you’re probably not spending your entire pension or even most of it. If you’re a retired teacher, you probably are.

My point was that leaving details out gives people an excuse to dismiss the entire point of the article. I was looking at it from the perspective of changing and winning minds. People will look for any way to resist changing their minds.

deleted by creator

Nothing is the issue. I don’t want something extra. I’m trying to gain understanding through conversation. Repeating to me that income isn’t part of net worth doesn’t help me understand. I have done some quick reading and it appears you can indeed include your pension in your net worth calculations. It isn’t necessarily just income. Seems different financial advisors handle pensions differently. Just like with a house. Some will include the value of a house in net worth, some won’t because the value of the home is not liquid.

Either way that wasn’t my original point. My original point was that the upper comment never said that including pension in net worth would turn him into a billionaire. And I was also trying to make the point that a complete picture should be provided so that some people do not simply dismiss the article entirely for one missing detail (as people will and often do use any excuse they can to change their mind).

I hope that clears my position a little. I’m not trying to argue despite what you and others might think.

Future pension payments are income, not net worth.

Would that not depend upon the pension? In my experience (albeit limited) some pensions have a cash value and you may take a lump sum upon retirement.

If he already received the lump sum then it would be part of his current wealth.

Sure. But I guess I’m just thinking that a retirement account (be it a Roth, pension, etc) has a cash value that should be a part of one’s net worth. Just because it hasn’t been cashed out yet doesn’t mean it has no value.

Just as I would include shares of a company that someone owns but hasn’t sold as a part of their net worth.

IRAs and other retirements savings can inherited if the person dies before or after they retire. Pensions can sometime be collected by surviving spouses, but are generally something you only get if you live long enough to receive them and they are not inherited.

The former is something you have (wealth), the latter is something you will get (future income). Kind of like the difference between the value of those shares now and what they could be worth in the future.

So you define wealth as only that which you can leave to survivors? That makes sense. I did some reading and it appears including pension in net worth calculations is something that varies among financial advisors. Some don’t even include the value of your home since you can’t readily access the value of that.

I’ve always thought of net worth as total assets minus total obligations/debts. And I view a pension as an asset. But given how you’re defining wealth, that makes sense why you would opt not to include a pension in net worth calculations.

deleted by creator

2 teachers, military and Congress. I’m not saying they’re billionaires, or even that they’re closer to one than normal.

deleted by creator

It’s a different retirement method than the average American that has to save up a shit ton in 401k assets.

deleted by creator

Sure, but when you’re taking about Americans at retirement age, net worth is important because it allows you to retire comfortably. That’s why they tie together in most folks mind instead of focusing on pure income or net worth. He’s got a reason to have a lower net worth and still be comfortable.

deleted by creator

So you understand why the framing is valuable but want to be a pisser about it anyway?

It helps me. I was questioning either the facts or his intelligence, as it doesn’t seem like he has enough money to buy/rent a house when he leaves the governors mansion with no income. I was wondering if he gets his governor pay for life or something… I had forgot about other pensions. Scolding someone for giving information you didn’t want is how we got Donald trump…

deleted by creator

At no point did anyone say the article was deceptive, just that it didn’t dive very deep into the pension. Probably the writer just doesn’t know much about them. Which is sad. Journalists used to be allowed the time to learn up on things for an article. So you are defending the article from a perceived complaint that no one made. You just don’t want to hear anything bad about the article you liked. Just like trump was never told he did anything wrong while growing up. That is the connection. Don’t put you head in the sand, the article missed some useful detail, someone pointed it out. That is all that happened here.

deleted by creator

Yeah he and his wife both have a teachers pensions, so what? They earned it working as teachers their whole lives. We should bring real pensions back for every American anyway, not this 401k shlock.

They did and we should.

Only the portion of a pension income that is not spent is included as a part of net worth. Given the average expenses of a 60 year old and the piss poor pension of the average schoolteacher, I imagine there would hardly be any money of his pension that isn’t spent and is considered part of his net worth, no?

If I had an investment account that would give me $10k per year, it would be worth about $125k. If I was entitled to $10k a year through a pension, wouldnt it be fair to say that entitlement is an asset that’s worth (at least a portion of) that same value?

Is that money being spent, or saved? If it’s being spent in a year on regular expenses, how would that contribute to net worth?

Most peoples’ pension is spent, not saved, because it’s meant to replace their working income in order to allow them to pay the bills. In Walz’ case, is it at all similar to the example you gave? Like come on, let’s not enter fluentinfinance levels of hypotheticals.

deleted by creator