From a Reddit user:

I briefly went through the documents about this and the entire thing is mostly about a push towards a single capital market. The most notable points are:

-

Launch of an EU-wide, auto-enrollment to Long Term Savings Product, which looks like a pension fund/savings account where citizens of the EU will be able to invest, leveraging tax incentives

-

Harmonisation of EU Member States’ regulatory frameworks

-

Implementation of an EU-wide capital market access-point for small and medium enterprises so that they can have access to capital from the entire EU

-

Rollback of some red tape around the scrutinisation frameworks

-

Creation of European Green Guarantee - an EU-wide scheme of guarantees for banks to mitigate lending risks to help green investment projects and companies get liquidity

-

Introduction of a new scheme combining the European Long Term Fund with tax incentives

-

Pan-European payment infrastructure with the Digital Euro

-

Widespread availability of supranational AAA EU Bonds to increase flexibility of the European Central Bank

https://www.reddit.com/r/europe/comments/1ilmxfn/comment/mbwsdbj/

But the article is worth reading

“It’s not against the American credit card, it’s about the fact that we are not able in Europe to build up European credit cards,” Letta said, estimating that some $300 billion a year in European savings are going into the US financial market, to a US company.

This annoys me even in Australia

I read an interview with some guy who participated in designing a digital euro and he said that the project was deliberately handicapped at its end by Visa.

What annoys you?

If I open a debit/credit account at any bank in Australia I get access to one of two networks, Visa or Mastercard, both American, no other option, why? Is this really the end game for credit card networks, 2 companies made in the 80’s?

How Credit Controls Your World - Ordinary Things https://www.youtube.com/watch?v=UGJ051u38Xo

Why can’t good old fashioned local Australian companies rip money out of “suckers”?

I don’t understand why if I make a credit card payment between 2 Australian bank providers America should get a cut of the fee

There’s also:

We have a perfectly functional, highly modern and universal debit card system in Germany, girocard. It’s when I’m in other EU countries that the downgrade to the visa/mastercard networks takes place. Transfer fees are between the seller and their POS provider/bank, but generally cheaper than handling cash. It piggybacks on standard wire transfers, which are unified in Europe (via SEPA).

It’s also where a lot of the “Germany only does cash” myth comes from. No, the restaurant isn’t accepting only cash they realise that you’re a tourist and only have a credit card which is a hassle (and chargeback risk) they don’t want to deal with.

That one card does contact & contact-free payments, it’s your ATM card, and second factor for online banking.

If German cooperative, public and private banks can agree on a standard why can’t the rest of Europe just take it up, just as they do with various DIN norms. We’ve had this shit since the 80s, growing out of ATM cards turned into cheque guarantee cards.

seems like a nationality thing? or at least he was implying french and italian people wouldn’t “because it’s german”

“Why? For a very simple reason. We, the Italians, will never pay with a French credit card. The French will never pay with a German credit card. The Germans will never pay with a Spanish credit card. And so the fact that we are accepting that American cards are the only credit card we use, is the effect of fragmentation.”

I just don’t quite understand how it’s 2025 and these standards are just finally on the verge of potentially being started

It would be the French or Italians paying with French and Italian cards which happen to follow a German standard. There’s no one German company behind it, it’s an interoperability standard set by the whole German banking industry. Who are very much open to take other banks on board, publish everything very openly, don’t demand license fees for those standards, whatnot.

Spaniards definitely manage to give out Girocards to their German customers, both Santander and PNB Paribas are playing on the German market. I bet they also offer the standard HBCI (or whatever it’s called now) software interface so you can hook it up to your accounting program etc. It’s a standard feature in German banking, even the bank’s web interfaces use HBCI on the backend to talk to the mainframe.

Years ago, before creditkarma, Fico scores and credit reports in my Amex app, and vantage scores and reports in my chase app, back when you had to go to annualcreditreport.com and wait for your shit in snail mail: I went to Fry’s for a TV. They had some percentage off for applying for a store card. I was denied, which freaked me out because I thought my credit was really good so I assumed identity theft fucking my shit up. I paid with my normal card (still got the discount for applying), went to annualcreditreport, and waited; only to find out everything was fine.

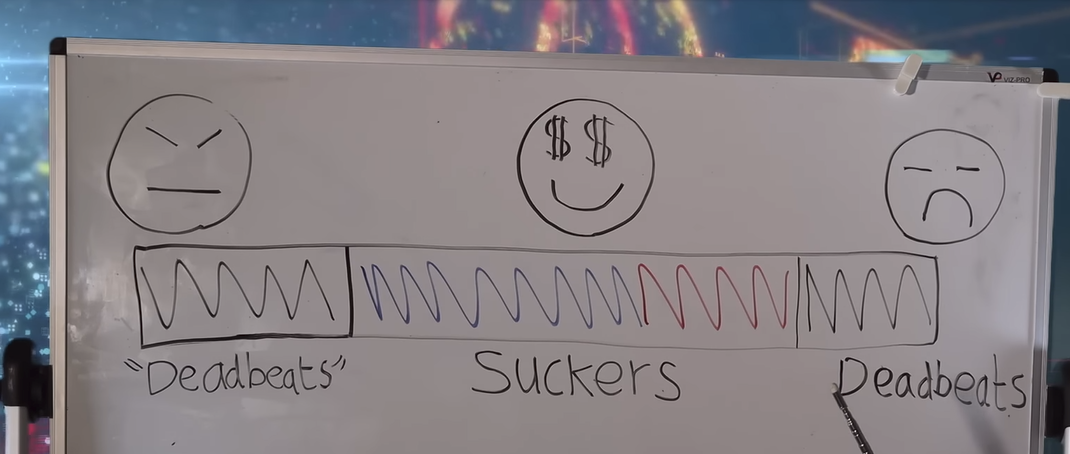

I did some research and found out the industry considered me a “deadbeat.” Not because I didn’t pay, but because I did. I was the type of person that would get all these signup benefits and pay things off on time so I never got hit with all those retroactive usurious interest charges. I was rejected for having good credit.

The fact that it’s legal to purposely extend credit to people who can’t afford it to trap them in debt slavery is fucked up.

As I understand from the brilliant hosts of the weekly EuroIntelligence podcast, which everyone here should be listening to, Europe’s most pressing need is for exactly this: a capital markets union.