I’d rather not further cement tips as a fundamental part of our economic system. It’s gotten so stupid to the point where you get asked for a tip before any service has even occurred and then the “service” is often just counter service which used to not be tipped. By not taxing this income, you’re encouraging more income to be paid through tips to avoid taxes. When you’re making all these little exemptions and special cases, maybe it’s time to rethink the fundamental system so that it works better as a base case rather than having all these poorly-applied bandaids.

Anything to not pay people a living wage.

This will be the gateway to removing tipped minimum wage and eventually minimum wage. People often forget it is not just the employee that pays taxes on tips, but also the employer. This will also hurt an already struggling SSI system. I’d really like to see a detailed breakdown of a 10 year outlook on this plan.

How about you do something so people aren’t reliant on tips in the first place?

Progress takes time. Overton window and shit like that. Babysteps. Slow, but steady.

This isn’t progress. It is actively incentiving having compensation be tips in the tax code.

Yeah, it really seems like it will compound the issue.

deleted by creator

So creating two classes of low income people from a taxation perspective is being leftist?

Like someone else mentioned, all this would do is incenstivize tipping culture from a restaurant/worker point of view, rather then the better option… Company that employs the person should be paying them, crazy idea.

Exactly, it’s just a non-solution

Politics is funny, like an oversized truck driven by an oversized grandma whose reflexes have slowed with time. The truck is unwieldy due to its size, and the driver often unable to see over the steering wheel until there is a bump that causes her to glance at more of the road than she’s used to seeing. Even when Grandma does react, the truck is slow to move, and if it moves quickly it runs the risk of tipping over.

We do need bigger change. That change will NOT happen overnight, too much damage has been done. What we need to do is walk back the worst damage, reinforce codes and laws to stop them being overturned by holiday worshipping dick heads, tackle creating a foundation to work off of, and then work towards larger, more meaningful change. In that order. Maybe swap around the middle as needed if blocked by certain justices.

Every single inch will be fought for. Every real change challenged. Harris and the party she hopefully recreates will need our support. Even Old Man

WillowBiden bowed when we sang our song loudly enough, together.But this is not an improvement, this is dividing the middle and poor classes into two categories from a taxation perspective, those who get all their earnings from their employer and those who get some from their employer plus some from clients as tip, your friends could have the same total income but pay 10k less in taxes because half of it is tip.

And we can effectively shift that balance. I will never willingly advocate for things that hurt people. Though I can be ignorant just like anyone else. What I will do is ask us to come together and seek positive change in the most effective ways, even if that means a temporary set back, so long as there are plans to shore it up quickly. This is because I recognize that short-term sacrifices will probably be necessary to achieve a more positive, bigger picture outcome.

HOWEVER, as we are seeing and experiencing, we as a united voice can help enact better changes and less sacrifices by all yelling into the wind. Seems that when enough people do it, our voices carry rather well.

Ok, so you’re just here to talk like a politician instead of talking about the subject of the conversation, got it 👍

This is stepping backwards. It actively incentivizes companies to not pay a liveable wage because tipped income doesn’t get taxed.

surely you mean incest ivises /s

I just tried fixing the typo and fucking autocorrect changed it back four times before it gave up and accepted that “Incentivizes” is a word.

Up until I wrote this post, when it took another 4 tries…

That’s what they told us with Obama, and Clinton and look where we are. Fuck that. Either actually be a leftist or get out of the way for someone who will.

It takes exactly 4 years until the term is over and nothing gets done.

kolanaki being based as always…

Tips are bullshit and workers should be required to paid a living wage.

and now the employee’s are going to be asking for more tips instead of wage, so they pay less tax.

You think everyone one asking for a tip at the cashier is bad now?

Wait till they put this in.

You think everyone one asking for a tip at the cashier is bad now?

Yeah, this will just make it even more prevalent for sure.

I think the proliferation of tips at almost every register instead of being limited to full service has been bad since the trend started.

In my state restaurants pay the federal tipped minimum of just over 2 dollars an hour. Their entire income is based on tips, and until they are required to be paid a living wage, tips are a necessary evil. I tip them well because I know they are getting screwed on their paychecks more than any other job.

Keep in mind that cash tips tend to not be taxed, which means less going into social security, medicare/medicaid, and other government services. It is still income! But when it was mostly cash it was effectively tax free.

Now that cards are prevalent it is getting taxed, and this ‘no tax on tips’ bullshit instead of requiring a living wage just benefits business. It is a counterproductive ‘fix’ and fuck tipping culture altogether.

You know what the worst outcome of non-taxed tips will be? The fucking wealthy tipping each other tax free to move money around. That is what it will end up being in a couple decades because that is consistent with every other similar ‘fix’ that just avoids requiring a living wage.

Where I’m at it’s automatics, for restaurant jobs 10% of the bill is calculated as additional income for the employee who’s got their name on the receipt, if they want to add more to their taxes it’s up to them but otherwise income is income is income and people need to pay taxes on theirs.

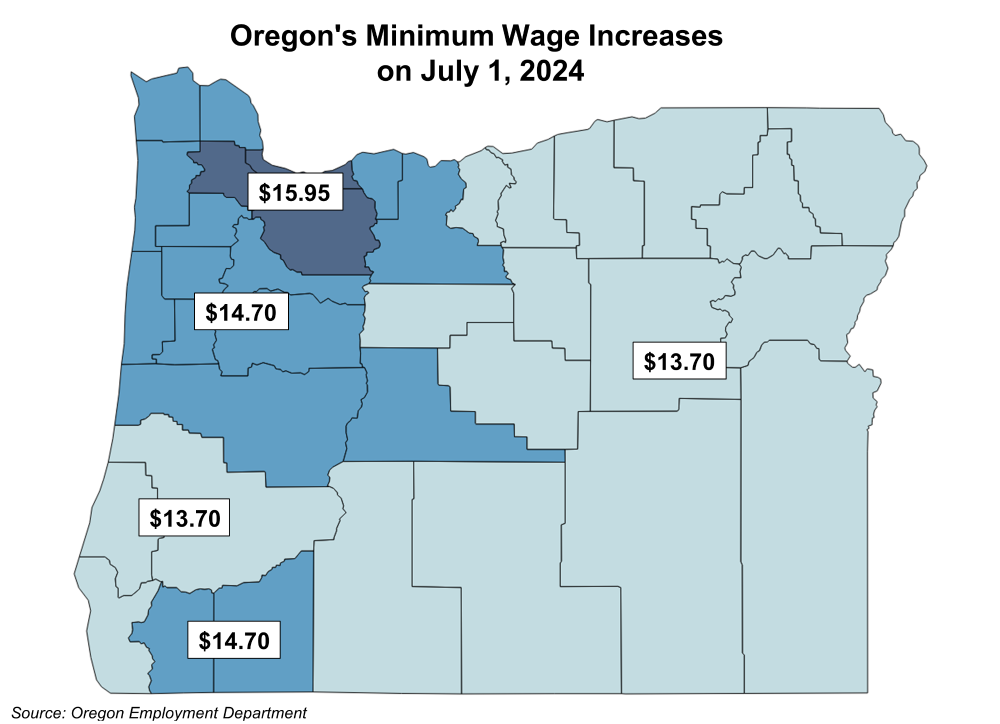

In Oregon, even tipped workers make the state minimum wage, but what that wage is varies depending on location.

Portland metro has the highest, it just went up on 7/1 to $15.95.

Other population centers like Salem, Eugene, Roseburg, Bend, Medford, and tourist spots on the coast have a lower rate of $14.70.

The rural areas where there are more meth labs and cows than people are at $13.70.

Map:

Good for Oregon. Until a living wage is implemented nationwide it is a problem that needs to be addressed.

You call that a living wage? In Washington the minimum is $16.28 statewide, including tipped labor, and it’s $19.97 in Seattle.

What’s wild to me is that the cost of a meal is the same as in places like Pennsylvania where a waiter can be paid as little as $2.83/hr.

Almost like the cost is set by the market, and the owners will cut wages as low as they’re allowed to simply to take more for themselves.

You call that a living wage?

No. Good for them having servers paid more than the $2 and change national minimum wage.

No sales tax here so the wage can be lower. :)

Ignoring the fact there’s no sales tax on many of the largest expenses (food, rent, healthcare), $14.70 + 10.4% (the highest sales tax in WA) is still lower than the lowest minimum wage in Washington, and in rural Oregon counties the minimum is only $13.70.

In Oregon, even tipped workers make the state minimum wage, but what that wage is varies depending on location.

How is a varying amount depending on where you live a “state minimum wage”?

Because it is established by a state law.

Why not abolish the tip system and require easier gets real pay instead?

i agree with you. interestingly however, my tip worker friends do not like this idea

Only because wages across the board are in the dumpster. If the kitchen guys were making $30/hr instead of $10/he they’d be complaining the other way

Your tip worker friends have been tricked into thinking that a consistent living wage would be less money.

there are a few tip workers who have a talent for getting a little bit more out of customers but you are correct i think

Looks like many haven’t read the article before commenting. While both candidates have a proposal about the same topic, the methodology of implementing this seems to differ greatly.

The reaction in the comments appears to reflect more of the potential outcome of the Trump plan, though the Trump plan seems to mainly be some cobbled together bits of some other Republican proposals.

From the article, the Harris plan goes along with a minimum wage increase and an income cap so higher wage workers can’t collect tax free “tips” in lieu of taxable income.

I also looked up some implications of elimination of taxed tips and found this article that goes into some numbers and shows how raising the standard deduction to make more workers, not just tipped workers, exempt from income tax and benefit many more people. I thought that was interesting and provided more seemingly useful info than either candidates’ campaign promises.

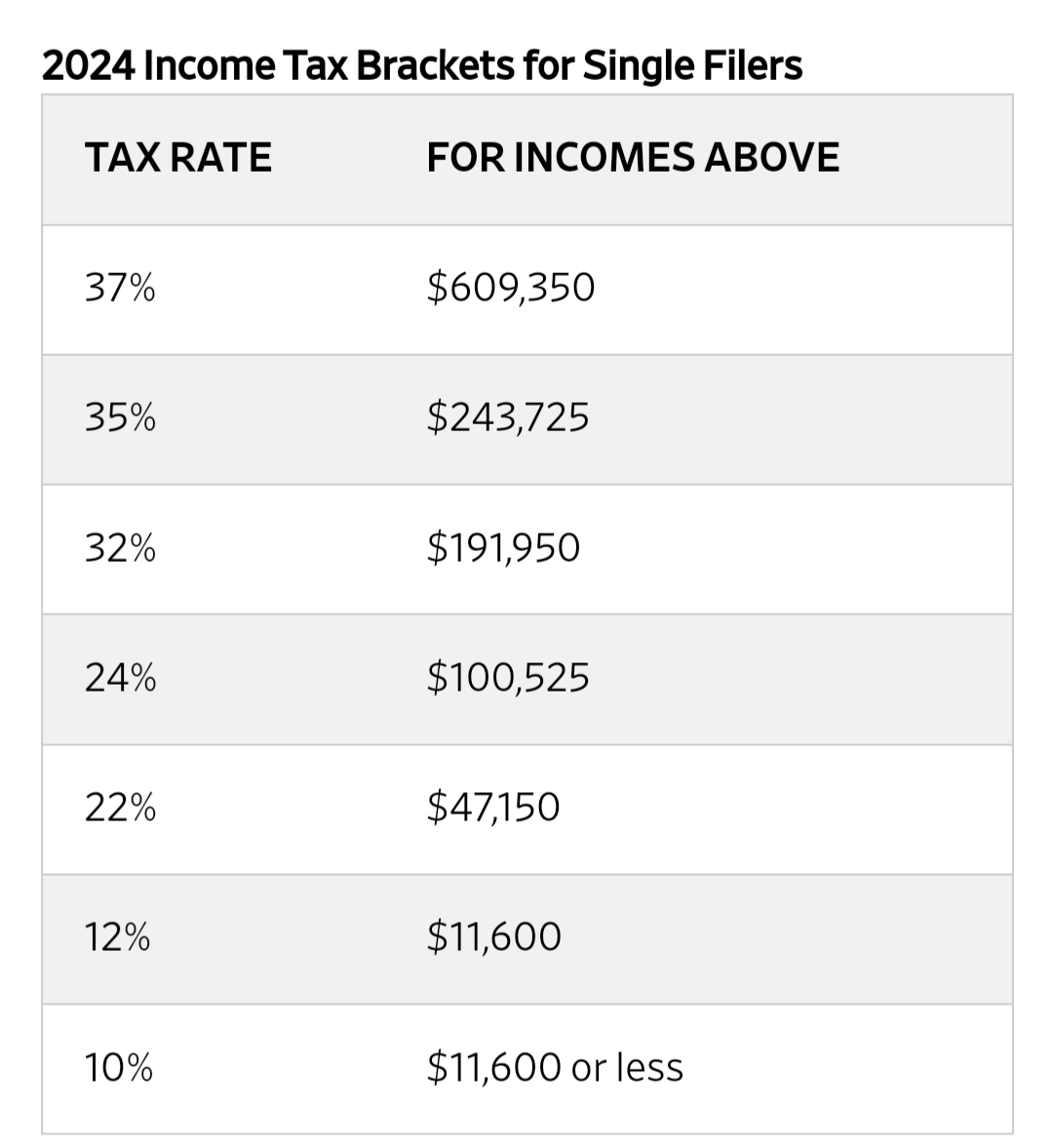

The solution would be to increase the lowest tax bracket then.

That’s another fine suggestion.

The numbers didn’t really look in line for today’s incomes, and from what I can tell from this, tax brackets for anything but the highest earners haven’t changed other than an inflation adjustment since the 80s.

Wish my wages were taxed at those brackets

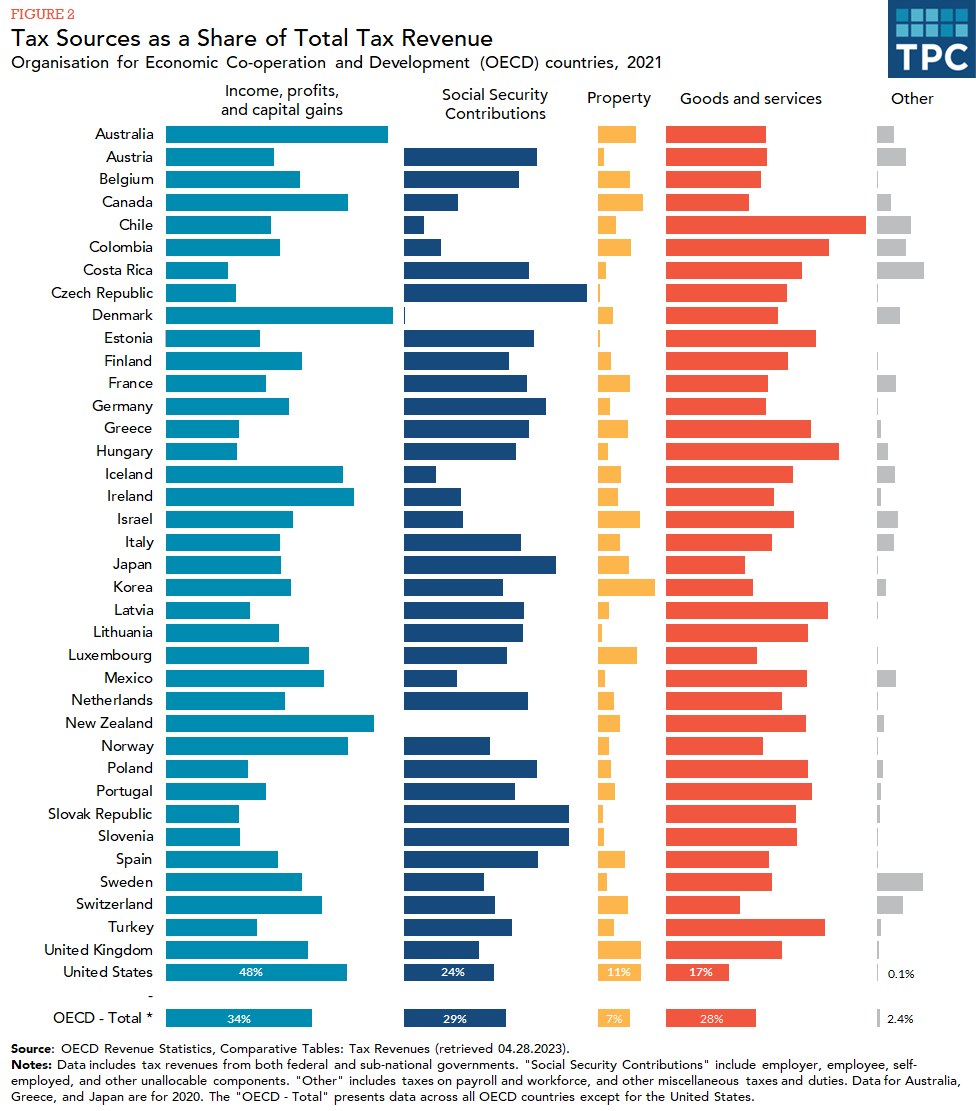

I’ll guess if you’re non-US, you’re also getting things for your taxes such as healthcare and other services. For us, it’s essentially a la carte pricing, so for many of these people in the lower tax brackets, healthcare is much more than taxes.

The bottom 50% of earners pay about $700/yr in federal tax. State and local taxes, property tax, school tax, and sales tax on top of that. “Average” income tax is $15,000, only due to wealth disparity. The bottom 50% pay less than 2.5% of all income tax.

Average healthcare cost is around $14,000/yr, so even for solidly middle-class people, healthcare costs are the same or higher than paid taxes, so that is probably much closer to, if not more than you may be paying.

Paying tax is a civic responsibility. The real pain comes from not feeling like you get what you pay for. I’ve no issue with coughing up some cash for safe roads and food inspectors, but when we have bridges collapsing and healthcare isn’t considered a human right, it makes for some discontentment.

Before any taxes are applied, we pay 13,08% for social security. Then taxes are applied according to following brackets:

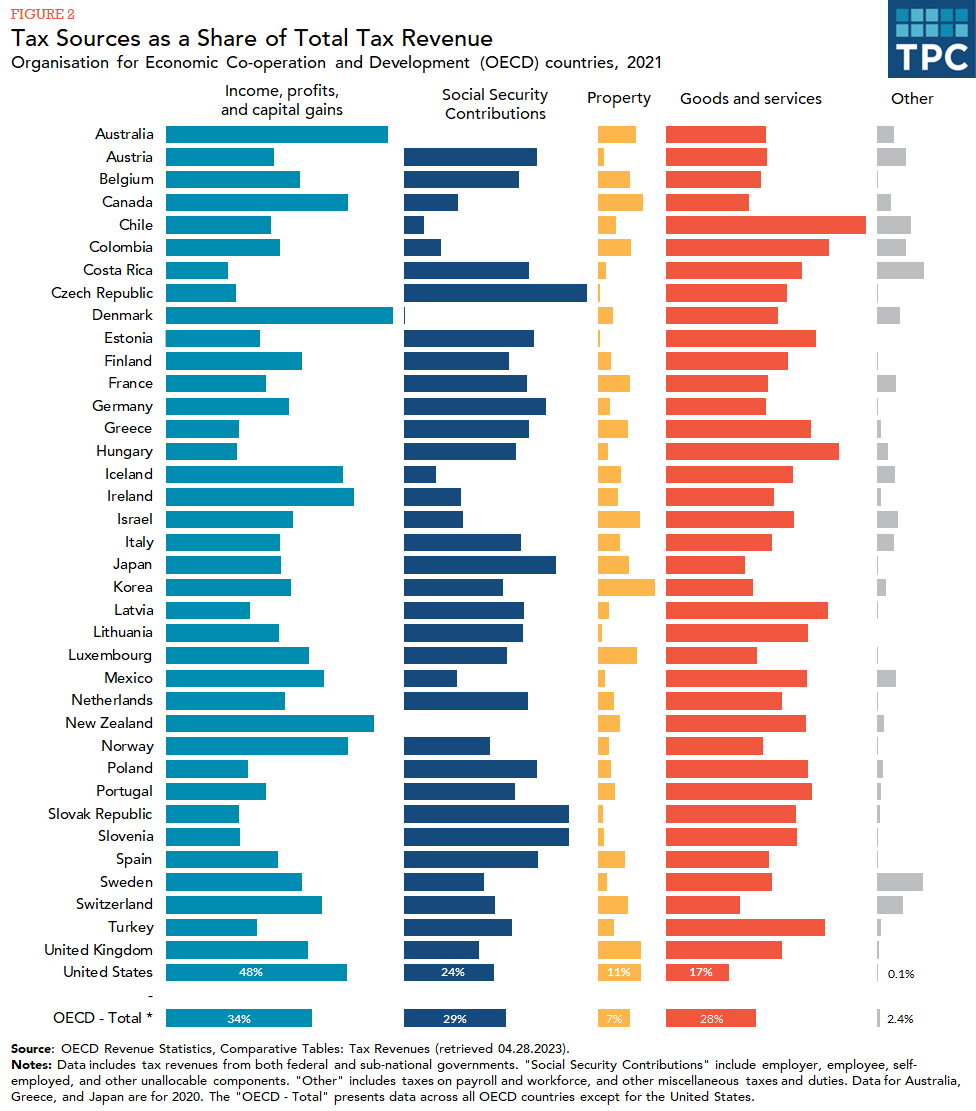

Wow, that chart does look crazy high in comparison.

I always think VAT looks wildly expensive as well.

I found 2 more charts and each country looks to have fairly different ways of taxing people, making it hard to see who’s getting the best and worst deals. Especially as the taxes go to different things.

This is just federal income tax and doesn’t count tax contributions towards medicare and social security (which is capped after a certain level, so someone making $1 million a year pays the same toward social security as someone making the cap which is currently around $160k). It also doesn’t count state income taxes.

The us also has a $14,600 standard deduction that effectively adds a 0% bracket and increases the lower thresholds by that amount (people in the higher thresholds would probably itemize, decreasing their effective tax even further).

The IRS does index the tax brackets for inflation.

Also, that table does not include state taxes.

There is a lot more to it than the table. I think it was OP’s article mentioned that there were bills circulating to eliminate the state income tax on tips as well as just the federal.

I mentioned some of the other taxes in my other replies a bit, but other than paying taxes, I’m not much of an expert. Plus if most people couldn’t be bothered to read the original article, I’m not going to look up a bunch more data they won’t read. 😁

Our taxes could be worse, but they could also be much better. I don’t know if these tip tax plans will do much, as it’s <3% of people making tipped income according to the article if I’m remembering it right from yesterday. Something that would help the bottom 50% of earners seems like it would be worth the effort instead, instead of cementing tip culture as a substitute for fair wages, but that’s just my opinion.

I’ve only ever lived in states that don’t have state taxes, only federal. That said every place I worked when I was younger had people just lying about their tips by claiming they only made tips that came from cards and pocketed all their tips from cash and never reported it. As cash has slowly disappeared more and more I’m sure that is dying off but tips were never a good thing for society. They are “politically correct” bribes. Then when companies realize customers will bribe their workers to be more helpful they got greedy and started taking those bribes. To which we made laws about stealing their bribes, so they paid politicians to make minimum wage separate for commonly bribed positions, effectively making it legal to steal bribes from their workers.

Making a portion of jobs qualify to not be taxable in parts of their income and not others regardless of tax brackets would be unresponsible. We are complicating a system that doesn’t need to be more complicated, and all that does is make more room for loopholes and exploitation (whether it be if the worker or of the taxes that should have been paid).

My experience talking with waitstaff friends mirrors yours.

They all swear they’re getting the better end of the deal because they have good nights, but there’s gotta be dead nights where they make nothing, and I can’t imagine disability or unemployment is good when your wage is $2/hr.

To me it’s passing the cost of labor onto customers in a less than transparent manner, and with wage theft by employers seeming to be a problem with restaurant staff, I don’t know how you can prove stolen cash tips.

It varies, usually the ones I knew would make more money than those working back of house without an issue. Back of house would get paid say $10 an hour and work a 9 hour shift. Front would come in for 6 hours and leave with ~$150. Creating a natural divide between the two.

So the title is misleading?

It’s just a title, it says what the article is about, but it can’t say everything. But when everyone comments based on the title and not the article, we risk creating misinformation.

Trump and Harris can both say we should not tax tips, but if that’s the end of the story from Trump, but it’s part of a multi-pronged approach, that’s what we need to be sharing and commenting on.

Everyone’s points about tipped jobs being exploitative are correct, but that isn’t what the article is about. If we just take it as Harris and Trump both want to do the same thing, that’s a half truth, and that is what many of these comments perpetuate. Both sides or this are not the same, and it does a disservice to us all to treat it as such.

Having a more descriptive title can help, like if it said “Harris presents competing plan for removing tax on tips,” but it is somewhat redundant as they wrote the entire rest of the article about it. I feel this is why we include the article with the post, and not just the title, no? 😉

I feel I’m sounding a bit harsh, which isn’t my intent, but it irks me when I can go through a comment section and see just about everyone has missed the point.

Ok. Got it. Sounds like a misleading title.

This doesn’t sound like a good idea at all. If a person relies on tips for a livable wage, it should be taxed. If you work for tips, it’s taxable income.

No one should be working for tips as their primary income anyway. Pay people a living wage.

I intentionally go to support restaurants where I know they pay their employees a living wage.

Echoing the other comment, tips shouldn’t be the main source of income at a job, so they shouldn’t incur taxes.

This sounds like a reason for companies to rely even more on tipping to compensate their workers… How about instead we make the companies pay the taxes on worker income earned through tipping? Then we can finally do away this ludicrous system we’re all pressured to abide by.

Bingo, if they don’t have to report tips every employer is going to say minimums and say they must be lying if it’s more or less.

Wow I actually really like that idea. I don’t think I would’ve ever come up with it myself. It’d be cool to have a candidate platform made up of the best crowdsourced policy ideas.

This is utter nonsense. Outlaw tips and make them subject to normal minimum wage.

I’d rather we focus on paying people appropriately and getting rid of tips

If this was a “Trump idea”, why didn’t he do it while president?

He got paid 40$ and a meal at McDonald’s

Just one of the many hundreds of things he talked about doing and then never brought up again.

He was too busy showing everybody he was a president.

Meeting with world leaders and shaking hands.

I’m sure in his lifespan he has shaken hands fir as long as I have masturburbated with my hands.

Cool. Now let service workers get paid a living wage. Then set the minimum wage to a calculated value based on the rate of inflation and regional cost of living, instead of the idiotic fixed value system. $15/hr is at least 10 years too late.

But that would leave the elites with less money to be trickle down to the economy. Don’t you see the flaws in your proposal?

Maybe we should talk about the history behind taxing tips…and Social Security checks. Hint: it was Ronald Reagan and he raised them to pay for cutting taxes for the wealthy and corporations

Thank you! I did not know that.

It always comes back to Reagan. This is what happens when you elect an actor celebrity with fucking active dementia to office. He becomes a useful tool to enact policy that the general public does not benefit from because he can remember the lines and deliver it in a package that they are willing to swallow.

Let’s not do it again.

So many people worshipped this fucking asshole for decades. All it takes to impress a large number of Americans is a couple of cruel quips.

Why shouldn’t people pay taxes on tips, though? I pay taxes on 100% of my income…

My answer would be that there shouldn’t be tips. Everyone should be receiving a living wage and tips should be relegated to the vulgar past.

I agree, but that’s not an answer to my question. It’s an answer to a different question.

Because, in the vast majority of cases, those who are getting tips don’t even get guaranteed standard minimum wage, but something substantially lower. Most of the time, these are people who are going to get an EIC anyway, so just let them keep it in the first place.

Doesn’t make any sense, income is income is income, if it’s a remuneration you get for work you accomplish your should pay taxes on it. You’ve got waiters making 100k a year (before you say that doesn’t happen, I worked with a bunch of them) that would pay taxes on 15k and the rest would be tax free while you make 60k a year and pay taxes on everything?

And, if we get rid of tipping and pay them a fair wage then all of the smoke and mirrors / abuse goes away. Further, maybe you shouldn’t be paying much if any taxes on 60k/year…

Quit falling into the logic trap that this is a fight between those who don’t get enough. The rich need to be paying a hell of a lot more and the poor need to be paying a hell of a lot less.

You’re mixing issues there, this is exactly what eliminating taxes on certain forms of income would lead to, fights between people of the lower classes, I can tell you from experience because at my previous job we were in this exact situation, salaried employees knew that tipped employees didn’t pay taxes on everything they got and would work against them when negotiating to renew their collective agreement instead of joining hands and fighting against the employer.

The fact that rich people don’t pay their fair share is a separate issue entirely and even if then did it wouldn’t make it ok to eliminate taxes on certain work related forms of incomes instead of adjusting tax brackets.

Most of them don’t already. They just don’t report cash tips on their taxes. This was a cheap way for Trump to gain votes, so Harris went along with it.

So much that is wrong with our country now was put into motion by that shitstain and his cadre.

That’s nice. But she needs to get on with raising the minimum wage to a living wage and pegging it to inflation/COL.

Anything except exactly that is a waste of time and resources. A PR stunt.

Wait… Why wouldn’t tipped employees pay taxes on that part of their income? Or am I not understanding what they mean?

Until Reagan there wasn’t any tax on tips because it was considered gifts, not income. The word ‘gratuity’ still reflects that.

Not much of a gift anymore when everyone expects a minimum of – what is it now – 25%? The expected minimum percentage keeps increasing as people endlessly grandstand about the amount they pay because of how much workers depend on tips for their income. Then there’s shame at play if you don’t comply, with some thinking it’s okay to mess with the food if one doesn’t pay the expected minimum “gift”. It’s really just extortion at that point.

If I gave you $100 as a birthday gift, would you expect to claim it as income?

Is my birthday work that I accomplish in order to earn money?

I don’t know how you can think that a gift is the same as remuneration. Meet the workers after their shift to give them a hundred if you want it to be a gift, but if you’re giving it to them as compensation for the work they’ve accomplished while they’re on duty then it’s income.

It’s not remuneration though, it’s literally money I already paid taxes on that I’m giving to a server as a thank you. I’m not their employer.

The salary they’re being paid by their employer is money the employer paid taxes on that the employer is giving to the employee to compensate them for the work they’ve accomplished, if they hadn’t accomplished that work the employer wouldn’t be giving them that money just like you wouldn’t be giving tip to that person if they hadn’t accomplished work for you.

You’re arguing in favor of creating two classes of lower income people, those who pay taxes on all their income and those who pay taxes on part of their income only and in some if not most cases it’s the majority of their income that would be tax free.

Hell, just the fact that their base salary is lower BECAUSE they get tips is proof that it’s considered to be part of their income, if they were paid the same base salary as anyone else and everyone could get tips at the client’s discretion you might have a very weak argument, but right now you simply don’t.

That doesn’t make any sense, it’s part of income

I’m thinking in the political game theory, it makes sense because it’s going to force Republicans to either support it or oppose it, either of which will make them look silly as trump supporters.

The revenue losses would need to be made up in another way, which would ideally be closing loopholes and more dependably taxing the wealthy. That is assuming that the segment of revenue from tips is even substantial enough to matter.

Anyway it’s going to force the Trump camp to respond. And pretty much every time you do that it provokes more unforced errors from them because they are clueless.

It’s just going to let him parallel his abortion stance where he claims Dems are for his positions until he does them

Just another note, Biden has also mentioned he would sign this into law. This would be even better for Dems than Kamala’s promise. For an election cycle, it would basically delete any value of Trump’s promise to tip earners.

I’ve seen “no tax on tips” on Trump billboards on my area. Clearly Trump thinks it’s an important issue. Having made them waste money would be a hilarious win, also preventing undecided voters from turning out for Trump on this single-issue is a clear strategic design.