- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

According to the states’ own estimates, the revenue hit could be more than $10 billion in fiscal years 2023 and 2024.

This article was originally published by the Center for Public Integrity, a nonprofit investigative news organization based in Washington, D.C.

A mia Edwards lives here because she wants to make a difference. But in this majority-Black city, long starved for funding by the state’s mostly white Legislature, that’s proved a steep challenge.

The city’s recent water crisis came after years of chronic underfunding of Jackson’s aging water infrastructure. The stench lingers in Edwards’ front yard after raw sewage flooded her home twice — neither the city nor the state agreeing to help. Abandoned homes blemish her south Jackson neighborhood as residents fled for better-funded communities. And at her nonprofit that prepares Jackson youth for performing-arts careers, she sees the results of cash-strapped schools when her kids struggle to read scripts and rap lyrics.

Then Mississippi further sliced into its revenue to fund such needs by cutting income taxes in a way that mostly benefits its wealthiest — largely white — residents.

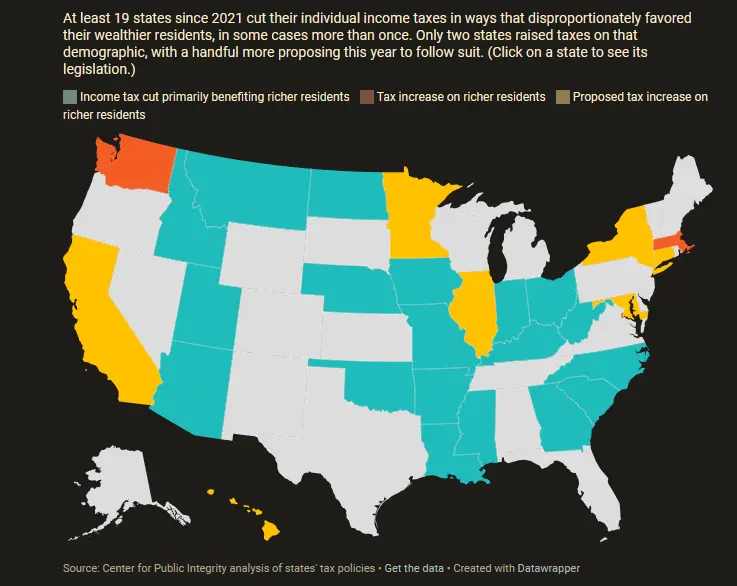

It’s one of at least 19 legislatures that seized the opportunity to do so in the midst of budget surpluses fed by federal pandemic funding. The expected revenue hit, according to the states’ own estimates: more than $10 billion in fiscal years 2023 and 2024. That’s more than double the entire 2023 general-revenue budget for the state of West Virginia, one of the states making cuts.

Residents of Jackson, such as Edwards, say the move to disproportionately lower what the wealthy pay in taxes will further undermine communities that suffer from disinvestment. They worry that more budget cuts will come for essential services, like public education and infrastructure maintenance. Lower-income residents, they warn, will be hurt most.

“The wealthy tend to always look out for themselves,” Edwards said.

Conservative groups funded by rich political donors pushed these tax cuts. It’s a well-oiled machine working to ensure that the highest earners in every state pay as little in taxes as possible.

A network that includes the American Legislative Exchange Council (known as ALEC), the State Policy Network, Americans for Prosperity and their member groups have advocated for tax-cut efforts in at least 21 states in the past two years while opposing efforts to raise taxes for the wealthy in at least eight others, according to a Center for Public Integrity investigation. Their funding sources include billionaire Charles Koch and a dark money fund used by wealthy conservatives.

The groups have it down to a science: ALEC disseminates model bills. The State Policy Network puts out research and commentary promising economic benefits. Americans for Prosperity handles on-the-ground lobbying. And in a few cases, groups in their network sue.

Mississippi House Speaker Philip Gunn, a Republican who sits on ALEC’s board, introduced that state’s income tax cuts in 2022 — something he had tried to passbefore.

Mississippi’s tax structure already took a larger share of income from its poor and middle-income residents than its richest, according to an analysis by the Institute on Taxation and Economic Policy. That’s common nationwide, driven by states’ reliance on sales taxes that fall hardest on people with the least money.

The main way to at least partially counterbalance that: income taxes with rates that increase as income does.

Gunn’s bill, which a State Policy Network member group campaigned for and ALEC lauded, would eliminate Mississippi’s graduated rates and replace them with a “flat” tax. It passed the Legislature in April 2022. Now everyone in the state pays the same income-tax rate.

And the gap between the share of income that people with the least and most money contribute to the government will worsen. According to an Institute for Taxation and Economic Policy analysis, the state’s highest-income group would receive an estimated $31,400 in tax cuts on average per year, while the lowest would get an average of $20.

Gunn did not respond to requests for comment.

Washington state, meanwhile, has tried to ease the burden on its lower-income residents from a system that disproportionately taxes them, but the same network of conservative organizations tried to stop the effort.

Washington is one of only nine states without an income tax and heavily relies on its high sales tax to fund its government. After a decade of attempts to make the system more equitable, the Legislature in 2021 passed a tax on certain types of capital gains — the profit on sales or exchanges of assets, like stocks — over $250,000.

The Freedom Foundation, a conservative think tank that’s part of the State Policy Network, filed a lawsuit on behalf of Washington residents to overturn the tax before the governor had even signed the measure.

“There is a general hostility to taxation, considering it theft, which is false,” said Lisa Graves, the executive director of True North Research, a progressive corporate watchdog group. “The second component is tactical. They want to limit the power of government — state and federal — and one way is to limit their revenue to fund things like public schools.”

ALEC, Americans for Prosperity and the Freedom Foundation did not respond to requests for comment. In blog posts, legislative testimony and other public comments about their tax efforts, the groups say that states benefit when taxes drop.

State Policy Network spokeswoman Camille Walsh said in a statement provided to Public Integrity that the group’s policy priorities include “reducing state income taxes so that there is a lower tax burden on taxpayers, while balancing other important objectives like tax environments that incentivize investment in the United States.”

The new cuts are the latest front in a quiet financial war over taxes as a tool to consolidate wealth and power — to the detriment of lower-income Americans and people of color. The same conservative groups organized a similar campaign roughly a decade ago.

Kansas was a high-profile example. Its 2012 legislation was designed with help from a former Reagan administration adviser on ALEC’s board of scholars, economist Arthur Laffer. Proponents of the tax cut claimed it would increase economic activity and pay for itself. Instead, the state lost hundreds of millions of dollars in revenue, slashed public spending, hurt its credit rating and eventually repealed the tax cuts.

This year, Kansas’ Republican-led Legislature tried again, passing a flat tax like Mississippi’s that state fiscal estimates said would reduce revenue by $330 million annually.

Americans for Prosperity and a Kansas-based State Policy Network organization were among those in favor. ALEC testified that the lesson to take from 2012 was to pair tax cuts with “appropriate spending reforms.”

Multiple studies have found that income tax cuts, especially those that mostly benefit higher-income households, don’t have significant impacts on economic growth or unemployment, but they do increase wealth inequality.

Democratic Gov. Laura Kelly vetoed the bill. She cited the budgetary disaster after the previous tax cuts.

“I refuse to take us back to an era of chronically underfunded schools, four-day school weeks, crumbling roads and bridges, and crippling debt,” Kelly said in April. “That’s exactly what this bill would do.”

Republican Kansas legislators have vowed to try again next year.

In Washington state, where the capital-gains tax survived its legal challenge, a lopsided tax structure is at the heart of inequities faced by lower-income people, said state Sen. Joe Nguyen, a Democrat who represents a Seattle-area district.

“We have so many billionaires here who have been able to build wealth and generate value because of the resources and the people in Washington state,” Nguyen said. Revenue from capital gains “is an investment in the community that helped build their businesses and that will generate economic opportunities in the future.”

“Intolerable in Any Modern Society“

States braced for tough economic times in 2020 when faced with the COVID-19 pandemic. But many found their coffers flush with cash in the following years.

The surpluses were largely created by federal pandemic aid and other factors, including consumers purchasing more goods than services, helping states because the former is taxed more than the latter.

Members of Congress thought states might use the fleeting budget boost of the stimulus aid to cut taxes, and the law is written to prevent that. But states sued. A federal appeals court ruled that the provision was unconstitutional.

This set the stage for the flurry of state income tax cuts passed in 2021, 2022 and 2023.

Reversing a tax cut is politically unpopular. So when state budgets contract, cuts to public services follow. Public education is often one of the largest cuts, as K-12 education makes up big chunks of state budgets.

Lower-income residents feel that most keenly because they don’t have the money to, for instance, seek out a private school if their children’s public schools are badly underfunded. Higher-income residents often won’t feel the same reduction in quality in their local schools — and they’re the ones getting most of the benefits from the tax cuts.

The changes in tax policy will hit hardest in states where funding for public services already is low.

In Mississippi, households with incomes below $30,000 will receive only 7% of the savings from its tax cut despite making up more than half the state, according to an analysis by the Urban-Brookings Tax Policy Center.

Households making more than $100,000 will get 55% of the savings, even though they’re just 12 percent of all households.

Meanwhile, the state will likely see a $419 million reduction in revenue every year on average, according to a forecast for the next decade produced by the University Research Center, a division of Mississippi Institutions of Higher Learning that studies state and local policies.

That revenue reduction is equal to salaries for 8,700 teachers at the state’s average rates.

Or it’s equal to state funding for childcare for more than 70,000 children.

It also is equal to almost half of what state and local officials have estimated is needed to fix Jackson’s water system.

Six months after the Legislature approved the tax cut, the NAACP and nine Jackson residents filed a Civil Rights Act complaint with the U.S. Environmental Protection Agency alleging that state decisions about water funding are discriminatory.

“The State has repeatedly interfered with Jackson’s access to tax revenue and repeatedly reduced or blocked funds from flowing to Jackson for its water facilities,” the complaint alleged in the aftermath of a days-long shutdown of the city’s water supply. “The result is persistently unsafe and unreliable drinking water and massive gaps in the access to safe drinking water that are intolerable in any modern society.”

The EPA is investigating the complaint.

West Virginia, the second-poorest state after Mississippi, approved a more than 20% reduction in income taxes in March. The new law could phase out the individual income tax entirely over time if the state’s sales-tax revenue growth outpaces inflation.

But the state’s fiscal impact estimate projects a loss of nearly $700 million in revenue next year alone.

That amount could pay the salaries of nearly 14,000 teachers at the state’s average rate.

The top 1% of earners in the state would receive an average tax cut of about $10,000 per year, according to an analysis by the Institute on Taxation and Economic Policy and West Virginia Center on Budget and Policy. The bottom 20% of earners, the groups say, would receive an average of $21 per year — less than the cost of a tank of gas.

In February, as the Legislature considered the plan, Republican Gov. Jim Justice held a roundtable forum with two State Policy Network partners, Americans for Tax Reform and The Heritage Foundation, to hail the march to zero income tax.

“That would be a flashing billboard around the country to entrepreneurs, businesses and to workers that West Virginia is open for business,” Stephen Moore, a Heritage Foundation distinguished fellow, said during the forum. “You have a big surplus, don’t flounder. This is a magical moment for the state.”

Asked for comment, Moore said in an email that people at the bottom of the income ladder benefit the most from pro-growth policies like cutting income taxes. He said he tells State Policy Network organizations across the country that eliminating the income tax is a proven path to prosperity.

That argument lacks context, said Richard Auxier, a senior policy associate with the Urban-Brookings Tax Policy Center.

“If you’re in Mississippi and West Virginia and you think the only difference between your states and Florida and Texas is income tax, I really think you ought to be doing a whole lot more looking,” Auxier said. “The reason you have an income tax is to shift the burden onto higher-income households. The reason to get rid of an income tax is because it can shift the burden onto lower-income households.”

The disparate impact of these income tax cuts can also be seen across racial groups. Auxier found that Arizona and Ohio’s 2021 tax cuts, for example, mostly benefited white households, while Latino households in the former state and Black households in the latter saw little to no benefit.

In Arkansas, the nation’s third-poorest state, the Legislature has lowered the personal income tax rate repeatedly, most recently in 2022 and 2023. Legislators cut the corporate income tax rate, too.

Arkansas is home to Walmart’s headquarters. The Waltons, whose family founded Walmart and are among the richest in America, contributed $1.2 million to the State Policy Network in 2021 through their foundation. The money was earmarked for “an education policy and advocacy program.” (The Walton Family Foundation is among Public Integrity’s funders, providing a grant for improving national-local news collaborations.)

One State Policy Network affiliate in Arkansas touts the income tax cuts on a list of its accomplishments. Another affiliate advocates for the state to eliminate its income taxentirely.

For some advocates in these poor states, the loss in revenue is alarming.

“We have so many other issues to deal with,” said Kyra Roby, a policy analyst with One Voice Mississippi, an advocacy group. “The state is embroiled in a welfare scandal, a health crisis in the aftermath of the Dobbs decision that originated out of Mississippi. We have one of the highest maternal mortality rates. Our rural hospitals are closing. Education is still underfunded. The residents in Jackson are still fighting for clean drinking water. But tax cuts are being pushed by outside interest groups.”

State Rep. Ronnie Crudup Jr., a Democrat who represents south Jackson in the state’s Legislature, voted against the tax cuts. He said the surplus of funds used to justify the cuts could have been put toward urgent problems.

“I just don’t understand, for the life of me, why we continue to try to cut taxes when there’s so many needs across this state,” he said.

Kelly Allen, executive director of the West Virginia Center on Budget and Policy, shares the same concerns in her state. Tuition for state colleges doubled over the past decade as West Virginia’s funding dropped, according to an October analysis by her group.

“Instead of further future revenue growth going to schools or infrastructure or healthcare or programs that benefit families, it will automatically be diverted to income tax cuts, which mostly benefit the state’s wealthiest,” Allen said.

Advocates of tax cuts often argue that they will attract businesses or that the money is better spent by taxpayers directly. In Mississippi, both those arguments draw skepticism.

“If you’re not funding basic services, there’s no new businesses moving to a state where your kids can’t get an education, you can’t move your products out on the state roads and bridges, you don’t know where the closest hospital is going to be,” said Sarah Stripp, managing director of Springboard to Opportunities, a Mississippi nonprofit that works with low-income families.

Added Nancy Loome, executive director of The Parents’ Campaign, a public school advocacy group: “You can give me money back, but I can’t hire public school teachers or pave the roads by myself. There are so many things Mississippians want that are why we pay taxes.”

“The Number One Issue”

The 2010 midterm elections saw a wave of conservative wins across the country. Republican-controlled states — where the party held the governor’s seat and both houses of the legislature — jumped from nine to 21.

The following year brought a slew of similar proposals across these states to weaken unions and collective bargaining power, scale back access to abortion and voting rights, expand the ability to buy and carry guns and lower taxes on wealthy people and businesses, as documented by Alexander Hertel-Fernandez of Columbia University in his book, “State Capture.”

Many of these bills were largely identical. They were introduced and passed with unusual speed. And it was thanks to the trifecta of ALEC, the State Policy Network and Americans for Prosperity.

ALEC, which first launched in the 1970s, is a network of conservative state legislators, philanthropies, wealthy donors, advocacy groups and private-sector businesses that drafts and disseminates “model bill” proposals for state legislation.

The State Policy Network is made up of state-level conservative, pro-business think tanks that produce reports, media commentary and testimony, often on behalf of bills that ALEC drafts.

Americans for Prosperity, the newest of the three organizations, was created and directed by the Koch brothers’ political network. It conducts electoral work and policy lobbying at both the state and federal level.

Financial disclosures show that donors to these organizations, in addition to the Walton Family Foundation and Charles Koch Foundation, include the foundation for the Coors family of Coors beer fame; the Sarah Scaife Foundation, started with money from Pennsylvania’s wealthy Mellon family; the Roe Foundation, whose businessman founder was an adviser to President Ronald Reagan and started the State Policy Network; and the Thomas W. Smith Foundation, a major funder of the anti-critical race theory movement.

But many of the people underwriting these groups’ efforts are anonymous. They send their money through DonorsTrust, which shows up as the contributor instead.

That obscures who’s benefiting from the tax cuts that their donations — tax deductible in the case of the State Policy Network and ALEC — helped bring about.

In 2021 alone, DonorsTrust funneled around $48 million to the State Policy Network and its affiliates and partners, including ALEC and Americans for Prosperity, according to the organization’s latest financial disclosures. On its website, DonorsTrust describes its donors as “conservative- and libertarian-minded.”

“We help streamline our givers’ charitable wishes and don’t comment on the specific policy positions of the organizations our accountholders recommend grants to,” said Lawson Bader, president and CEO of DonorsTrust, said in an emailed statement. “That said, our givers are ideologically diverse and over the years have directed their giving to more than 1,100 unique charities, some of which approach the tax-policy debate from different perspectives.”

A 2019 investigation by the Center for Public Integrity and USA TODAY found that Mississippi’s Legislature introduced more ALEC model legislation than any other state in the country.

“I don’t understand the state thinking the way they think,” said Credell Calhoun, a Democratic supervisor of the county where Jackson is predominantly located, which he said struggles to get state funds to fix roads and bridges. “But I think it’s coming from the national Republicans, pushing, pushing down here to cut taxes.”

Usually business groups are reliable supporters of such a move. But in a 2022 reportdetailing the concerns of local business leaders, the state’s chamber of commerce wrote that “the Mississippi tax environment was not high profile nor ever discussed significantly as a priority.”

ALEC’s 2022 annual report credits ALEC legislators for helping to dump graduated income tax rates in five states. A State Policy Network member, the Goldwater Institute, describes itself as having helped write Arizona’s 2021 tax-cut law. In nearly every state with a recent income tax reduction that benefited the state’s wealthiest households, these groups or their affiliates were there, promoting these policies.

“This is the No. 1 issue that we’ve heard from Utahns all over the state, and the No. 1 concern is that they’re feeling the pinch in their pocketbooks with inflation at all time highs,” Heather Andrews, Utah state director for Americans for Prosperity, said at a hearing last year for a tax-cut bill.

The legislation passed. She urged Utah to cut even more.

And this year it did, with a law the state estimated would reduce revenue by $475 million next year — the equivalent of average salaries for nearly 8,000 Utah teachers.

“Utah does more with less,” Andrews said in her testimony for this year’s bill, “and that’s what we do.”

“ALEC Puppet State“

The atmosphere was somber as people who advocate for policies that benefit lower-income households gathered in a modest, chilly conference room at a Homewood Suites in Jackson in March.

Advocates, local politicians and service providers bustled in and out, grabbing lunch and talking about taxes while keeping an eye on other legislative proposals in the waning days of the session.

Further tax cuts had been floated in Mississippi this year but didn’t make it through.

Even so, they know more will come.

A provision in the 2022 tax law requires the Legislature to revisit by 2026 a proposal to eliminate the income tax entirely. Everyone in the room worried about funding for education, housing, infrastructure and other public goods their communities rely on.

Roby, with One Voice Mississippi, laid out two potential policy solutions: raise taxes on the wealthy to bring in more revenue or enact tax credits aimed at lower-income households to make the state’s tax system less reliant on money from poor people.

Both seem unlikely in the state’s current political climate. For now, Roby said to the people around the conference table, her primary goal is to stave off more cuts.

Alicia Netterville, principal at Acclivity Group and former deputy director of ACLU Mississippi, listened and then turned the conversation to a basic right underpinning every other policy: “Your vote is your currency.” State decisions would look different, she said, if every Black person in Mississippi could vote and participate in state government equally to white people.

Overall voter turnout in the 2020 presidential election in Mississippi was about 60%, sixth worst in the country. Registering to vote here is more difficult than in almost any other state, Public Integrity found as part of a 2022 review of voting access. The state employs most of the tactics traditionally used to keep Black people from voting or thwart their influence in government, including felony disenfranchisement, racial gerrymandering and strict photo ID requirements at the polls.

“You have to pay to play in Mississippi, and that leaves out a lot of people,” Netterville said.

Among the groups pushing restrictions that suppress voting across the country: ALEC and the State Policy Network.

Such restrictions can help state officials enact or ignore policies without worrying as much about the breadth of support for the ideas.

A Mississippi Today/Siena College poll in January, for instance, found that cutting the state’s grocery tax, which most impacts lower-income households, is more popular than eliminating the state’s income tax.

Mississippi’s grocery tax is the nation’s highest. Most states don’t have one.

“You know, I will argue all day that we’re an ALEC puppet state,” Stripp, with Springboard to Opportunities, said at the March meeting. “I think the hardest part of this argument is that the Mississippi Legislature is not accountable to the people of Mississippi. How do we as people of Mississippi push them forward when it’s hard to make them accountable to their actual citizens?”

*This piece was reprinted by Truthout with permission or license. It may not be reproduced in any form without permission or license from the source. *

This is the stupidest timeline.

I struggled to find the list of 19 in the article itself, which was disappointing.

Here it is nicely in image for, the ones in blue being the 19

Why am I not surprised to see my state in the blue?

Thank you, tree.

So pretty much all dumpy red states full of dirt and trees.

Why is it no one can set up a decent opposition to ALEC? I mean hell it’s like people can’t even keep track of their public meetings. There should be media campaigns opposing everything they do.

They have unlimited money. The left relies on volunteers. The right has paid staff and they roll deep.