Did I say mandatory? I meant optional! You’re “free” to die in a cardboard box under a freeway as a market capitalist scarecrow warning to the other ants so they keep showing up to make us more!

I only make enough money to keep my family in this house and warm over the winter. But I am worth 10 billion dollars and would like a 10million dollar 💵💰 loan and forgiveness as I venture into this unknown business deal. Sounds good? Shake on it?

I am sure if net worth was based strictly on taxed earnings, most rich people would get in line to get their money taxed so that they can boast about it in their yacht owners club meetings

Unrealized gains are the 200 push-ups Im going to do at the gym tomorrow, probably?

Or the full self driving Teslas that will be available next year!

They shouldn’t be taxed because they’re just that, unrealized. They may be worth next to nothing one day. If you use them as collateral, you’re still on the hook for the value you originally took out the loan for, regardless of the loss of the investment.

Except they are realized because they are being used to purchase things and/or make more money. It can do nearly all of the things that “realized gains” can do, without being taxed.

It’s bullshit and you know it.

If they truly are “unrealized”, then sure don’t tax them. But I think we need to change the definition of that term to include the actions that OP mentioned.

“it’s bullshit & you know it” good argument. Go get an education.

That wasn’t the argument though? Look, I will give it a strikethrough and it will not change the point of my comment in the slightest.

You completely ignore the entire comment except one sentence, and then you tell me to get an education? Lol

Who’s got the shit argument again?

This argument applies to my wages too if I elect not to be paid in USD. Are you arguing that, say, Bitcoin income should be untaxable just because it could depreciate relative to the USD tax liability it generates.

You’re getting confused between a payment & an investment. The medium in which you are paid is irrelevant. The payment is the end of the transaction and therefore is the point at which it is taxed.

Precisely. The medium of value delivery is irrelevant, as soon as you extract value by borrowing against an asset you have completed a transaction and therefore is a point at which it could (/should though that’s the debate I guess) be taxed.

In both cases (payment in bitcoin or borrowing against stock) your remaining position could go to zero leaving you liable for tax you don’t have money to pay, but that’s on you to manage better.

No, it doesn’t.

How could you misunderstand his comment so completely?

Bitcoin is not money. You cannot file your tax return with a line-item with the number of Bitcoin you were paid. On a US tax return, you have to say how many USD you were paid. On a Canadian return, it is Canadian dollars. In the UK, it would be GBP.

If I demanded that my US employer paid me in GBP, they may do so. They would also track internally the dates they paid me, the value in USD that they paid me, and the exchange rate to GBP. The tax deducted from my check would be in USD.

This is part of the tax code in every country. You get paid in the currency of that jurisdiction ( regardless of how you choose to take payment ).

If you wanted to receive Bitcoin, it would be an investment. The taxable income would be the value on the day I received it. The value on the day that I sold is irrelevant. This is not “unrealized gains” by any stretch.

You cannot “elect” how to be paid for tax purposes. The currency on your return is a matter of law as are the rules about moving in and out of that currency. This is practically the definition of “realization”.

If you wanted to receive Bitcoin, it would be an investment. The taxable income would be the value on the day I received it. The value on the day that I sold is irrelevant. This is not “unrealized gains” by any stretch.

Then someone better tell the IRS because this is exactly how they treat crypto. And yes, people can elect to be paid in Bitcoin, I recall seeing various stories about it over the years.

You can absolutely elect how to be paid, you can earn income abroad, receive benefits in kind, stock compensation etc. ALL of which may still be taxed. If your tax return only relates to dollar items, lucky you

The ignorance is strong in this one.

I know the 12 year olds will be upset but this is dumb.

Unrealized gains may never be realized. If they ever are, they may be worth less at that point than the tax you paid. It is like taxing everybody on income at the beginning of the year and then telling them tough luck if they get fired and never get that income.

Also, borrowing in assets does not make you wealthier. How much tax should we charge people when they get a mortgage ( not when they sell, when they first borrow ). I mean, somebody just gave you hundreds of thousands of dollars. Why shouldn’t you have to pay tax on that? ( according to the OP at least ).

Anyway, I will stop there. We are not going to get back at the rich by saying a bunch of stupid things. If you don’t like generational wealth, fine. Have an estate tax. If you don’t like windfall wealth, fine. Have a super high progressive tax rate. I have no problem limiting extreme wealth ( it won’t hurt me ). But “tax people I don’t like on things that make no sense” just tells people you cannot think well and are not into math.

That’s all great but then why the fuck am I paying property tax on my house that is mostly unrealized gains. Before you go arguing to abolish property tax, I’m fine with it. My property tax goes to make my neighbor better, and provide services and schooling for my neighbors.

Billionaires become rich because their companies benefit from highways, regulated internet, a public educated work force, etc… so they should pay their fare share.

Taxing unrealized gains for 99% is ok, it should be the same for the 1%.

Using stock as collateral for loans with insanely low interest rates is very, very common among even engineers in big tech. It’s a well known loophole passed on by the older engineers/managers at the companies to the younger ones. From the perspective of eventually paying the tax it doesn’t help, but inflation will outpace the interest on one of these loans so it does lower the effective rate and more importantly for the economy as a whole is cash earned/spent without having been taxed. Ya it will need to be paid back eventually, but that can take decades.

I think they were realized, in the OP’s example, when they were used as collateral for loans, etc?

If you’re just sitting on unrealized gains, then yea maybe they don’t necessarily need to be taxed. But as soon as you use it as a means to acquiring more money, then they become realized and should be taxed.

The thing about borrowing money might be one of the dumbest things I’ve read here. Do you honestly believe that people who have access to loans (typically at much lower interest rates than us normies), etc., that it doesn’t give them 1000x more opportunity to gain more than any normal person who doesn’t have those means?

Do you actually not understand how having money makes it wayyyyyyy easier to make money?

If you can buy shit with it, it has value and can be taxed. There’s no need for playing “Schrödinger’s Gains” where the value is simultaneously worthless because it may/may not be realized yet it’s leveraged into material wealth of every kind. It’s like saying rich people don’t have money because it’s all tied up in assets, but somehow they have multiple homes, a yacht, and private jet trips. That is an incredibly disingenuous argument that completely sidesteps how wealth works.

Yeah it’s really very simple. That person is being purposely obtuse for whatever reason (either they have a ton of unrealized gains that they themselves have been using as leverage for years, or they believe that they are a “temporarily embarrassed millionaire” who will need these lax tax laws in the near future when they are suddenly extremely wealthy somehow).

As soon as you use those “unrealized gains” to make more money, they become realized and should be taxed. Simple.

I figured they were just another billionaire apologist.

This is both a terrible strawman of advocates for this type of tax reform and a misrepresentation of what realization events are in the US tax code.

Sure “borrowing in assets does not make you wealthier” but it does provide an excellent basis for establishing increases in wealth that have already happened. Realization is a tool to avoid arguments and uncertainty around valuation, not a requirement that taxpayers have cash in a checking account to pay their liabilities. Posting collateral for borrowing inherently involves valuation so could very easily be made a realization event, it fits very neatly into existing law.

It may be a political impossibility but your dismissal doesn’t suggest you’ve really thought about it.

Also “taxing everybody on income at the beginning of the year and then telling them tough luck if they get fired and never get that income”. As someone in a high tax bracket (and state FML) who left the country mid tax year, bless you for thinking this doesn’t happen.

Both my examples are about being taxed on money that may never exist. Your second comment makes me think you did not understand me.

I am not talking about political impossibility. And I am certainly not talking about the difficulty in calculating current market value. I am talking about the poor correlation between current value and the gains that will potentially actually be “realized”. I am talking about bad policy.

Here is an example. Back in the 2000’s, there were people that were taxed on the value of their stock options using exactly this same logic ( the “value” on paper ). Later, when the market crashed, there was not even enough value left in the shares and options to pay the taxes already owing. People literally paid well over 100% tax ( in some cases hundreds of percent ). Who were these super rich people that deserved such tax treatment? Many were relatively young employees of technology companies using equity as compensation. These employees had little wealth before being taxed on their “unrealized gains” and may have been bankrupt after. The whole concept is incredibly flawed.

I personally dislike Elon Musk. But even with him, racing him on what he was worth at the high point would be totally unjust as he is not worth that now. It makes way more sense ( in my view ) to tax him when, and if, any of that wealth materializes. I am no fan of Donald Trump. But I think it would have been totally insane to tax him on the value of his Trump Media “wealth” when it was “valued” at $8 billion. If he gets even $1 billion out of it I will be amazed. Anyway, tax him on that. Tax it at 90% if you want. But don’t tax him on “wealth” that nobody is ever going to see.

I do not know what state you are in but I am unaware of anywhere that would tax you on “unrealized” income from your high-tax bracket salary. Nobody is taxing you on the “unrealized” benefit of your salary. Are you trying to tell me that it does? Where I am, leaving the jurisdiction for more than 6 months would render my income and gains beyond that point non-taxable so the government of course wants a “final return”. Are you talking about something similar?

Again, I am all for taxing the rich. Tax actual gains however you want. What I do not think you should do is tax “unrealized” gains. It is an incredibly flawed idea.

I was talking about withholding, where I am denied taxes that will never G gone d due On reflection maybe isn’t a perfect analogy.

You haven’t made a persuasive argument (or any argument really) against, you just keep insisting it’s a bad idea.

That wealth “materializes” when his company gets a new loan based on the paper value of his assets as collateral, even if he hasn’t materially realized that value yet. If you can get rewarded with new loans and government contracts based on paper valuations, you can pay taxes based on paper valuations.

This is the thing, I think. We’re talking about unrealized gains, but I think the definition of the phrase hasn’t kept up with the practical application. If the unrealized wealth is providing tangible value, e.g. as collateral for a loan, is it “unrealized?” Seems pretty obvious it’s very realized and should be taxed as such.

Serious question - who here is in favor of taxing unrealized gains and has more than $20k in personal investments? (Outside of retirement or other tax advantaged accounts)

This is legitimately the dumbest argument. You will just dismiss any commenters who disagree with you (“that’s your opinion, donate it to the government!”).

Besides, there are literal billionaires who will actually be affected by this clamoring for it. No one who has less than $100 million will be affected. No I don’t need a history lesson about income tax. If you want to live in a country without taxes, Somalia will welcome you.

P.S.: I have more than $20K in personal investments.

Would a home count as unrealized gains? Because I’d be fucked if I got taxed on it more than I already do.

You probably do get taxed on it ( property tax? ). However I agree that taxing you on the “unrealized gains” from your home would be insane.

Think of how many seniors with a fixed income would be out on the street if this was to happen. Little old ladies in houses they bought decades before. Tax codes often defer even property taxes for seniors as they recognize that these people do not have actual “wealth” outside of these illiquid assets.

Of course, those houses will eventually be sold. If you want to collect more tax, increase the amount of tax you collect on those actual gains.

“The law, in its majestic equality, forbids the rich as well as the poor to sleep under bridges, to beg in the streets, and to steal bread”

-Anatole France

I’m sure the status quo is just dandy to the 10% of Americans that owns 87% of American stocks, and especially the 1% that owns 50%.

The beneficiaries of societal privilege, which

earningmaking money without labor is, will always view anything that makes society more equitable as oppression. This is like seeking out the opinion of business owners on Jim Crow laws in the 50s.I chose the number because it is attainable to the median household with 2 years of saving 20% of their after tax income, but also substantial enough to feel the burden of risk associated with investing. Stocks are not guaranteed income, they are not money for nothing, and changing the playing field affects a lot of regular people just trying their best to build a reasonable amount of wealth, whether to buy a house or secure their financial stability.

I am not close to being a top 10% wealtholder, nor am I related to anyone who is, and I certainly was not expecting to have my investment question compared to complicity in mass racial segregation.

Why does it feel like you pretend people with less than a billion dollars or something in that order of magnitude’s neighborhood in unrealized gains would ever be affected by this legislation?

Laws like these should never affect you unless you’re one of like (I’m guessing numbers) 15 people in your country, so I don’t understand the issue people so often have with them. From my point of view, if we don’t change anything to combat wealth inequality, the most likely outcome is civil unrest (esp. with more climate disasters looming on the horizon)… genuine question, please don’t take it with hostility – I would just like to understand “the other side” here: why would you personally oppose this?

P.S. about to hit 6 (euro)figures invested. ≈50/50 stock/ETF split. But I’m not sure if that truly counts toward your opening question since it’s basically the place for my long-term savings money, but there’s no such thing as regulation for a tax-advantaged “retirement investing” (401k etc.) account here, yet 🙃

Fair question, honestly I think it’s ‘hacky’ and there are cleaner approaches. Regulating unrealized gains stands to cause a headache and costs for those navigating an already very complicated tax system.

To work the implementation would require everyone’s assets to be monitored and reported - extra work for tax software, brokers and taxpayers. Plus the development costs to comply with these regulations will be passed onto taxpayers and investors. Yes additional taxes would be recovered but are a drop in the bucket on the scale of the US economy.

To a lesser extent it also discourages regular folk from financial planning since it creates a public perception of “why should I own stock if it’s all doing to be taxed anyway?” further concentrating influence on institutional and super wealthy investors.

While I’m undecided on it, the solution others have proposed of regulating borrowing against collateral seem fairer as it puts the onus on the borrower to carry the admin overhead - regular investors remain unaffected.

Now my hot take - I think this is all a distraction from the real problem with the tax system Step up in Basis. If it wasn’t for step up in basis the gains would at least be taxed on the investor’s death anyway, but right now those who inherit stock get to permanently avoid the taxes on the gains (up to a certain limit). I suspect the politicians responsible for creating such legislation would be too directly affected to address that one.

We have defunded schools without enough teachers, school supplies, etc because the wealthy use the inane amount of capital they hoard to buy local government to cut their taxes. Then they set up Charter school escape hatches for some kids that they then profit from from publicly traded charter management companies. Those kids did nothing to deserve being caught up in their greed disease.

We have economic segregation from the cradle. That’s no fucking better. Making more money should let you have a bigger car/house/TV/widgets, but we let some make so much that they use it as a cudgel to extract more from us to our detriment.

But believe the dream all you like. Not like there’s hope since we’re literally terraforming the planet against being hospitable to us for millions of years.

Yup, but I don’t see how taking away everyone’s rights is going to help that situation. That’s the way it is. People seem to think only ultra rich people have unrealized gains. I’m sorry, b but it makes no sense to tax an unknown number.

Lol. You are ignoring the fact that we already tax unrealized gains: property tax. And that’s actually harder to value than something on a stock market.

An “unknown number”? When you open your Robinhood app, does it show numbers? Because if it doesn’t I think you need to message their help desk.

The only proposals are for massive gains above $100 million. I think a 1% tax on that would be just fine.

LOL. I don’t agree with property tax based on home values either.

What part of the stocks in a portfolio that you have not sold have no gain aren’t you getting? Yes, there’s a number in Robinhoid and tomorrow that number could be zero. Companies go bankrupt and when that happens, common stock goes to zero. Until you SELL the stock, there IS NO gain or loss.

The OP does not mention only gains over $100m.

The answer isn’t to tax them. It’s to not allow them to be used as collateral.

Sure that perfectly works because salaries are so high, I don’t need any other form of income at all. I’ll just forego any other investments because some rich guy might use them. Seriously, this is your solution? You do know it’s THAT rich guy that sets your salary, right?

The reason this is a conflict is that if profits are not managed democratically (as in a worker’s cooperative), then they will be extracted as profits for a small oligopoly (the owners) who can choose by their whim who gets a piece of that profit.

Very often that’s buddies in their back-scratching kickback network, with a smattering of highly productive workers.

You do know it’s THAT rich guy that sets your salary, right?

Which is why they need to be reigned in in a hundred different ways including this one.

Unfortunately, the self-hating laborers that would waste their lives advocating we get comfortable attempting to satiate the insatiable greed of our oligarchs in perpetuity seem to keep forgetting their greed disease has us on an ever dwindling clock to ecological collapse/apocalypse, meaning no salaries, just death. As much as you may not want to, this capitalist laborer hostage situation for basic survival will end, because the climate can’t be bribed, negotiated with, bought out, cut in, or outsourced.

No one solution can solve the problem of our greed class, and the top economic 10% of Americans own 87% of American stocks, so your attempt to frame this as an everyman issue is hollow.

Oh brother. Talking about a high horse.

So if you tax unrealized gains, the rich will still be rich but everyone else will simply stop investing. They will have no option but to only earn money from the rich guy. Oh but we’ll all have collectives because everyone who works wants to be an owner. And the best way to make any decision is to have a whole bunch of people provide input.

Look I’m all for eliminating the unfair rules that allow people to become billionaires. This rule is not one of them. And I’m sorry, but there are millions of people in the US with 401k retirement plans and they all have unrealized gains. They would all be effected. So don’t pretend this is ONLY a rich person thing. This isn’t a tax on the rich. It’s a tax on trying to become rich.

High horse? How? By explaining basic issues with capitalism that anyone who has paid attention to anything in the last 100+ years has recognized?

What an easy way to completely disregard an argument that makes you uncomfortable. I’ll have to remember that one.

I love the way you think I don’t understand these things. It’s just another tablet of condescension you dole out of your anti-social Pez dispenser. Have you actually READ and DIGESTED anything I’ve posted?

We should tax extreme wealth into oblivion, with a 100% congratulations you won capitalism tax at some point so they can’t collect enough wealth to start warping politics beyond their single vote.

No one should be able to live like modern pharoahs in a finite world with finite resources where others die of lack of resources.

Or, how about we just tax everyone equally and keep them from making the rules. Make a little money, pay a little money. Make a lot of money, pay a lot of money. As far as I’m concerned, if you can make a billion dollars on a level playing field, more power to you. Now pay up.

Or, how about we just tax everyone equally and keep them from making the rules.

I don’t know, Professor, why don’t you learn some history to figure that one out for yourself? Why do progressive tax brackets exist? Do you think they just appeared one day?

And still no reasonable argument on how/why to tax unrealized gains. Just more rich people suck and so do you for daring to suggest that not EVERY law allowing it is horrible.

I’m out of touch with reality for suggesting that we actually just tax people equally but OP isn’t out of touch for suggesting we suddenly put a tax on an imaginary number because many rich people might be able to abuse it. Classic.

Oh hey I just saw you a second ago… That’s weird. Almost as if you went into my comment history to try to bother me elsewhere.

That’s some weird shit, dude.

Who’s the “anti-social” one?

Because capital is an expression of power beyond material needs/wants, and even government can’t effectively govern a class of people that have enough capital to bribe officials en masse to literally bend the laws and regulations to their wills, including to make their bribery perfectly legal as they succeeded in doing here.

That’s why fiscal conservatives were so aroused by the idea of making government, the government that is supposed to protect the citizenry from the whims of those with more power, “small enough to drown in the bathtub.” They succeeded. Our government is subservient to Wall Street’s dictates because we let a few citizens accumulate enough, and shrunk government oversight enough, to turn it into just another acquisition to manipulate to maximize short term private profit.

That’s a really nice view point. I agree with what you said completely. The problem is, it doesn’t stress the issue we’re discussing.

I say, you should tax an unknown value. You say, billionaires are bad.

Ummm I didn’t know they could be used as collateral. I’ll have to research that. It doesn’t sound right to me for the same reason they definitely should NOT be taxed. How does that even work? You buy stocks and you hold them, then, what the government taxes you every year until there ARE no gains. Or perhaps the stock plummeted and you have a loss, but it’s ok, you lost money on the investment AND to the government. Until you sell an investment you haven’t made any money on it and it should NOT be taxed. If you have a 401k this would affect you too, not just rich people.

It’s how billionaires can buy things while allowing their sycophantic boot licking fanboys to cry “their wealth isn’t liquid!” anytime anyone proposes common sense tax reform.

This isn’t common sense. It’s stupid. Please explain how it works.

It’s simple, if you’re a billionaire prepare to get soaked

That sounds like a very compelling argument.

Haha ty. But in seriousness, I do think there is a level of wealth that one can attain that becomes political.

Like civil servants, attorneys, judges, healthcare workers, etc, are held to different standards and subject to different rules (same laws ofc), because of the power they may wield over others.

Oligarchs individually can affect the lives of millions of people. That’s the kind of power we put checks on.

Absolutely, but that’s not what we’re talking about. We’re talking about creating a tax on an unknown number that will apply to a lot of not rich people. And then taxing it again later for I -don’t-know-how-many times.

How about instead, we make a flat tax and remove loop holes in or any number of ways that apply across the board.

I don’t have a problem with people wanting to be rich or even being rich. I have a problem with how they get there and what they do when they get there. It’s completely unfair and oppressive, crushing people who dare stand in the way, forced labour, buying politicians, etc. I’m sorry but I’m not a communist. Just arbitrarily deciding anything a rich person does should be illegal because a rich person does it is just silly.

There has to be hedging requirements right? If you have 100 million of growth stocks for example, surely you’d need to have put option contracts for that loaning insitution to accept the risk of unrealized assets to secure a loan of that size?

Anyone know how that works? Im sure each loan is reviewed thoroughly for its risk at that level.

Put options are a specific investment vehicle. The OP is just making a blanket statement about unrealized gains. Many, many NOT rich people have unrealized gains. And there literally is NO value to tax. The investment could go bust and there is a loss, no gain at all. At what point in a long term investment is the tax assessed?

But the point of a put contract would be to lock in the strike price for a duration determined by the expiration date. If put contracts were purchased for the duration of the loan, the potential risk of being unable to pay the bank due to depreciation would be mitigated.

Like how farmers buy puts on their commodity to protect themselves from a bad year.

It costs money to buy a put contract to protect the loan.

So if you need a 1mil loan, now you also gotta buy puts that’ll protect a downturn of 1mil. So now you gotta sell stock which will be taxed.

I’d say, when it is used as a vehicle for any financial transaction. If an employee exercising stock options pre-IPO has to pay tax on something that they are unable to get any financial value out of for at least 6-12 months, there is no legitimate reason that unrealized gains used as collateral should not be taxed. It’s just another way to shift tax burden onto people who actually work.

Ok. How much tax do they pay? And later when that stock quadruples and they sell, do they pay again or get a free ride for the extra it’s gone up because they’ve already paid? How many times to they get taxed on it?

I’m not ultra rich, but I have stocks that I’ve been purchasing for decades. I’ll be damned if it’s fair that I be taxed on a stock for a company that may go out of business before I ever see any profit. Why do we even assume it will go up? How about we assume it goes down and I get to write that off my taxes now and sort it out later if the assumption is wrong.

You’re literally trying to tax people on an imaginary number.

Except they are using it as collateral to accumulate excessive amounts of wealth, essentially replacing their income, tax free.

Which is why the first commenter mentioned the tax should be used on unrealized gains that are used as collateral. Not just the unrealized gains themselves.

Also, yea, when they sell, they pay a tax. Just like everyone else. That is a completely separate instance of wealth accumulation that is unrelated to the wealth accumulated by using those gains as collateral.

Don’t like it? Don’t buy stock and earn your money through income from a job instead. It’s that simple.

Though tbh I think this entire discussion on share and stock is pointless. Profit paid to shareholders is wage that should have been paid to a worker; if you don’t perform labor for that company, you shouldn’t have any entitlement to the profits made from that labor.

Ultra net worth individuals, especially ones like Jeff Bezos with a lot of his net worth tied up in one company, can take a personal loan using his stock as collateral to keep up his lifestyle without needing to sell (and be taxed on) anything. It’s only really available for the 1%

Anyone can buy stocks in a margin account and then borrow against it as margin, and use that margin to make more money. If you can open a brokerage account, you can do this.

Shit can turn on you real fast though and you can lose a lot of money since you’re borrowing against the value of a fluctuating asset.

E.g $1000 stocks let’s you buy $400 on margin, but if that $1000 becomes worth less than $700 you gotta pay back that $400, but now you gotta sell at $700 or pony up more cash and that $400 you bought is also only worth $200.

They can be used as collateral because they are assets that have value. You can use your car or house as collateral too, and neither requires payment of federal income tax.

There isn’t a federal tax on most assets. It’s income that’s taxed. If your assets gain value they can be sold, at which point you pay taxes on that income, though often at a reduced rate (e.g. Capital Gains Tax for selling stock at a profit).

Except most state/local governments do have property taxes on houses, land, and cars. Not unrealistic to apply the same towards other assets. Specially since taxing homes and cars is counterintuitive because you’re taxing necessities, while taxing monetary/investment assets like stocks would make more sense to encourage more spending instead of just hoarding the money.

Most states don’t tax cars outside of sales tax.

They may have registration, but that’s different than tax and only applies of you use the vehicle on public land.

Property tax is usually school districts and municipalities, and is well-under 1% most planned.

And you can do the same thing. He got a loan using his stock as collateral. The stock has value. The bank can use that value to issue the loan as they see fit within federal regulations. They can do the same with your less than $100m portfolio.

How about we just make things fair so that the ultra rich pay their share? This is not the way. It literally makes no sense.

I’ve never made 6 figures before, but was asked to show my investment portfolio value when applying for a mortgage as it was part of my assets. Assets the bank could seize if I didn’t pay my bill.

TIL I’m the 1%.

That’s strange. I’ve had a few mortgages now and have never been asked to show my investment portfolio. Where are you and what bank asked for the info?

Canada. All of the banks I applied at asked for total assets, including TD and Scotiabank.

The poster you’re replying to is talking about something else. There’s a point where the terms you can get for loans using your stock portfolio as collateral are so good that you can count on your stock value growing faster than interest payments on the loan, enabling you to take out loans that amount to free money and live off of them (or use them on more investments that grow faster allowing you to take larger loans, etc).

Banks don’t mind because they reliably get their interest payments, can count on settling the account when the person dies, and of course there’s the social capital of being the institution that ultra wealthy people bank with. For an ultra-rich person it’s how they can have the liquidity to live an ultra-rich lifestyle even if all of their wealth is tied up in the market.

I still think anyone can do that, just on a smaller scale. Either way, sounds risky. Stocks sometimes go down as it turns out.

TIL I can use my stock as collateral in a mortgage

How is “collateral in major purchases” and “secure billions in loans” supposed to be any different?

The top 10% own 67% of the wealth in the U.S.

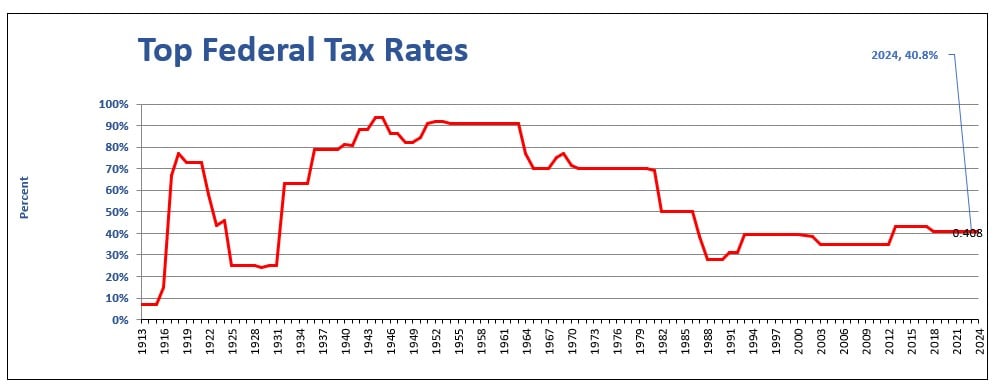

The tax rate during the New Deal (which corresponded with the largest jump in GDP and middle class growth) on people earning $200k and over (now would be like earning $2.5 million/year) was 95%.

During the 50’s through the early 80’s, that tax on the wealthiest was at 70%.

Now it’s at 37%, less than half of what it was during the best years of growth our country ever experienced.

This Unrealized gains tax would only impact people worth more than $100 million who do not pay at least a 25% tax rate on their income.

Additionally, you’d only pay taxes on unrealized capital gains if at least 80% of your wealth is in tradeable assets (i.e., not shares of private startups or real estate). One caveat is that there would be a deferred tax of up to 10% on unrealized capital gains upon exit.

In short, it would not apply to most startup founders or investors, but would impact top hedge fund managers.

They can afford it. TAX THEM.

Anyone seriously talking about the 95% rate can be safely ignored as a liar by omission.

The amount of stuff you could deduct was very different back then. Nobody actually paid 95%, regardless of what the law literally said.

There is a reason this person is not showing you per capita tax revenue over the same time period.

I’m curious, could you provided these numbers?

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

Wait…I pay taxes on my HELOC…

Simply tax it as if it underwent a buy/sell/trade. Capital gains and losses are accounted for in that at the time the value is utilized. They are tracked, and you don’t pay them later.

Reasonable home ownership (only home) could be exempted.

So you agree with the post then, given that that’s basically verbatim what the post is saying.

I think the key point in the post was “If ‘unrealized gains’ can buy stuff-then they’re realized. Tax them.”

Essentially, because the unrealized gains held in their stocks could be realized through a loan, all of their capital gains should be considered for taxation.

As opposed to just the assets used as collateral, that is now effectively liquid, should be taxed as realized.

I personally think we should do everything we can to disincentivize wealth hoarding, even if it’s an “unfair” or possibly somewhat broken system that does so, but it also doesn’t seem feasible as a kind of legislation you could convince anyone in the government to enact, since they’ll still be focusing on things like if it could possibly lead to a higher loss than the initial investment if they’re taxed on the gains for years, but it drops low enough to wipe out all the value they paid in tax and their gains, even if the actual price is higher than the purchase price.

Yeah, a bank isn’t going to give your a $500k mortgage on a $200k property, so if they give you a $500k loan on stock then that’s the value given to the stock at that point.

How does this make sense though? All collateral is, is a safety net to mitigate loss for a lender who lends to someone who then defaults on the loan. If the loan is not defaulted on, literally nothing happens to the collateral.

How then does it make any sense to consider the mere act of the loan being given as a realization of the collateral, in other words, equivalent to having sold the collateral, when literally nothing has happened to it?

Realization is the establishment of value not sale for cash (it just happens that the most convenient establishment of value for any non-fungible asset is sale). There are already some realization events that don’t have associated cash flows, to do with overseas assets or certain financial instruments. Ordinary people don’t need to worry about this stuff, it’s not for them, and if you’re rich you can trivially figure out the cash flow issue.

But capital gains avoiding tax for the life of a wealthy person who lives off collateral zed borrowing, then being stepped up in basis for their heirs is just embarrassing for the US.

Realization is the establishment of value not sale for cash

Absolutely nonsensical massive straw-grasp. If that was true, that would mean that everything that HAS a widely-established market price is instantly and permanently to be considered realized by everyone who owns it.

Relevant case law: “While it is true that economic gain is not always taxable as income, it is settled that the realization of gain need not be in cash derived from the sale of an asset” https://supreme.justia.com/cases/federal/us/309/461/

It is in fact true, and clearly then doesn’t mean that at all. We can and do control what constitutes a realization event, and borrowing is pretty sensible candidate. I don’t know why you’re losing you mind over this fairly prosaic idea.

You left out some pretty important context in that quote to make it seem like it’s saying that realization is arbitrarily decided. In truth, all this is saying is that realization is not confined to reception of cash itself:

While it is true that economic gain is not always taxable as income, it is settled that the realization of gain need not be in cash derived from the sale of an asset. Gain may occur as a result of exchange of property, payment of the taxpayer’s indebtedness, relief from a liability, or other profit realized from the completion of a transaction.

As it says at the end there, the ways to realize gain all necessarily entail “profit”. A loan is not profit, nor is an already-owned asset transform into profit when used as collateral.

The above could absolutely not be used to support your argument, nor refute mine–not when you read it honestly and in context.

The capital gain is the profit, the collateralized lending is the transaction completed to realize that profit. It’s a logical extension of accepted understandings of those terms and easy to imagine coherent legislation to implement.

You don’t like the idea, that’s fine. But it’s simply not true to claim that it doesn’t make sense and you haven’t been able to articulate any inconsistency it.

And WHAT gain exactly is being taxed? So you have a $1000 investment. The government decides, what, that you are a good investor and can make 20% so they’ll tax you on $200? So if you sell it at a loss, you get screwed. If you sell it for a 50% gain the government loses tax revenue? You know what, I’ll take that deal. I’ll invest money, pay the taxes on my unknown gain immediately, keep it for 20 years and boom, tax free, because I’ve already paid the taxes on the gain. You know I’m totally on board with this whole rich people suck idea, but this is just stupid.

ok, so I understand that you don’t quite get the issue, also your bad at taxes.

if I invest $50000 and make $100000 I don’t want to pay taxes on the $50000 I “made” (this normally would lead to the crime of not paying taxes) but if I use those $50000 as leverage on an extremely low interest loan for $50000 then I dodge having to pay anything in taxes while also, defacto, realizing my gains.

what OP is advocating for is taxing those $50000 you put up as collateral, making these $50000 similar to the original $50000 you invested, now should you again make another $20000 from said capital, and pull out, you would still have to pay capital gains on those $20000, or do you think you have to pay capital gains on money you put in? (hence why you’re bad at taxes) because tax is only levied on the positive difference

I love the way people on the internet have to insult to make a point.

I’m just glad you’re not the one making the tax laws.

I’m not insulting anyone, if you feel slighted about the fact that you didn’t understand OP, nor do you understand how taxes work, then I invite you to do some basic research about tax law in the US, because you don’t seem to know how taxes work

You know, I heard that rich people need air to live, we should totally tax the crap out of that. That would show them.

you’re lacking English or economic comprehension skills are no reason to start creating straw men, you’re wasting all that bedding for the rest of your fellow sheep

I don’t agree with unrealized gains taxes in general, but the instant they are used as collateral, or if value in any way is extracted from them (even loan value), they become realized gains, and should be taxed.

What you’re suggesting would also mean you’re advocating for middle class homeowners to be taxed on a full value of a Home Equity Line of Credit (HELOC) even if they haven’t spent a dime of it yet. Was that your intention?

Oh no, I guess our legislators’ hands are tied. It’s not like they could just put an exemption for a person’s first home into the law or anything.

Oh well.

They didn’t set out their whole tax platform for their presidential bid friend. We can trivially blow down your straw man with a primary residence exemption or, you know, tax brackets.

Homeowners are excluded from capital gains tax for the first 250k for individual filers.

I believe you’re referring to rules on sale of a home where there is a capital gain, meaning you bought the house for $100k and sell it for $350k, no cap gains taxes. We’re in uncharted waters with what @[email protected] is proposing. That user (possibly) suggesting it for HELOCs too.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Even normal capital gains taxes have brackets.

Okay but you can just apply the same logic to a HELOC. If you get a 30k HELOC for a bedroom renovation then it does not count towards capital gains tax.

Wouldn’t this be a double standard if we’re applying @[email protected] 's logic? The rich would get taxed on loaned money but the middle class wouldn’t?

The rich would get taxed on loaned money but the middle class wouldn’t?

Oh no… Anyway.

that’s like the point of the entire system? I mean, I don’t want to go back to the 1800s corporate baronies that defined most industry at that point in time

This is how… EVERYTHING works… Income tax brackets, 401k limits. I thought this was pretty obvious, from each according their ability and all.

That’s generally how progressive tax brackets work, yes. Technically speaking if I rich person wants to take out a 30k HELOC they’d also not get taxed on it.

Ah, the game of life! Where the rules are always stacked in favor of the rich. Seems like no matter how hard we play, they always come out on top. Count me in, though—I guess we have no choice! AMERICANAPPAREL

The URSS should have won the Cold War. There, I said it. Now downvote me.

The United Roviet Rocialist Sepublic?

That’s the spelling of the Soviet Union acronym in my native language LOL

Wait did they change it and get it wrong a second time? Now it says URSS

ROFL

Ruh roh.

I downvoted you for not being able to spell.

I downvote anyone who asks for or explicitly expects it. Even if I agree with what they say. I’m a people pleaser.

So with a 401k loan, which is kind of this, you are limited to borrowing against it by like only up to 50% of its face value due to factors such as market volatility. And then all payments made to that loan are with alreaey taxed income, so you aren’t securing money in any way that dodges taxation.

Also using shareholdings is no different from using a house or property as collateral… property equity has unrealized value until it is sold too. One might argue you pay property taxes on that equity, but ideally, th3 company behind the stocks you own pays property taxes for its ownings annually, so that’s still happening. So the real problem is large companies dodging taxes due to exploiting broken tax code loopholes.

You can’t use a 401k as collateral for a loan.

That’s not using it as collateral. That’s taking money out of it that you have to pay back to yourself. That means you’ll lose out on the growth in the markets that the people using their investments as collateral don’t lose.

Also, i think income tax is double taxation. Businesses are the key market players in an economy so why not orient all taxation around them? Do away with personal income tax and property tax. Keep/increase sales tax, luxury tax, sin tax. And clamp the largest salary in a company to be allowed no more than 20x the average salary in the company to address wage disparities. If the CEO deserves a 1 mil bonus, the average employee deserves at least a 50k bonus.